There are numerous ways to make money, but taking a forward-thinking attitude and getting in early should pay off. The cryptocurrency/ crypto industry as a whole is still in its infancy. So if you’re reading this, and looking forward to investing in crypto with a trading strategy, consider yourself fortunate to be in this position so early.

Understanding the foundations of technology and investing based on that understanding are two very different things. Along with this comes trading, which is an entirely distinct aspect of the crypto industry.

Let’s go through a few recommended practices that might put you in the top 1% of the wealthiest people.

Table of contents

- 1. Only invest what you can afford to lose

- 2. Never put all of your eggs in one basket

- 3. Choose a Trusthworthy Crypto Exchange

- 4. Avoid FOMO and prepare a Trading Strategy

- 5. Don’t Make Hasty Investments

- 6. Always keep an eye on Bitcoin

- 7. Don’t Be Greedy; Plan your Trading Strategy Visely

- 8. Mid-term and long-term

- 9. Always try to learn from your mistakes

- 10. Set stop losses if you are an Active Trader

- 11. Patience

- 12. Always test your strategy

1. Only invest what you can afford to lose

Crypto investing, like any other sort of investment, is fraught with danger. And sometimes, traders lose even when they do everything right. For example, the Bitcoin Crash occurred in January 2018, when the price of Bitcoin plunged by approximately 65 percent in the first month of the year.

The worst monetary losses ever experienced by traders in 2018. Markets such as cryptocurrency might be highly unpredictable. As a result, maybe the most important guideline to a trading strategy is: don’t spend more than you can afford to lose!

Losses are produced not only by the strategic methods of other investors but also by extraordinary causes such as hackers, defects, or even governmental policies or any black swan event.

Do you remember the Covid19 crash? Then, out of nowhere, Bitcoin fell all the way to $3,000. So make certain that you do not invest your life savings in any trading strategy.

Take a step back and re-evaluate your existing financial status before making any investments. Then, if you can’t afford to invest at all, don’t make impulsive decisions like using a credit card, getting a mortgage, or asking for loans.

2. Never put all of your eggs in one basket

One of the golden laws that many expert investors follow when investing is to never put all of your eggs in one basket.

When you invest in a single coin, you have a greater chance of making a larger profit, but the risk of losing more money is also heightened, if not greater. So, diversifying your investments and investing in several currencies is a wise way to avoid losing a lot of money if a particular currency suffers a setback.

3. Choose a Trusthworthy Crypto Exchange

The ideal broker is trustworthy and sincere. However, bear in mind that your investment is at play, so you’ll want to know that you can really put your faith in your broker. Also, be certain that your broker is licensed. This is the best way to ensure that they are trustworthy and verified.

Crypto exchanges also provide the finest digital security measures, the best execution pricing, and exceptional client support if and when it is required. Another important feature to look for in a broker, particularly if you are a beginner, is demo accounts and instructional tools for trading cryptocurrencies.

Look up everything you can about that broker online, including reviews and advice from more experienced traders. If you come across anything suspicious, don’t use that broker since you could be setting yourself up for a horrible trading experience that will cause you to lose a lot of money. Binance is the world’s biggest exchange for crypto trading, to learn more, read Binance Review.

4. Avoid FOMO and prepare a Trading Strategy

FOMO (Fear of Missing Out) is the most common flaw in investing, causing investors to lose money. As an investor, you may be concerned that if you don’t buy now, the coin will hit an all-time high, which may or may not occur, and the market may really move in a different direction, producing results that you weren’t expecting.

It only takes a little media buzz, a few financial experts’ comments, youtube influencers’ shilling, and a little nervousness on your part to make you choose the wrong option. In reality, it was the identical formula that drove Bitcoin values from $10,000 to $20,000 in December 2018 and from $20,000 to $64,000 in 2021.

In the preceding context, I should use the term traders rather than investors because investors have a mindset of investing in an asset and waiting for it to turn. It takes four years with bitcoin. Those that purchased top in 2018 have now more than doubled their investment, particularly with Bitcoin. Bitcoin is currently trading above $41200 at the time of writing this article.

5. Don’t Make Hasty Investments

When it comes to your finances, investing in haste means following trends or listening to other people (YouTube influencers, etc.) in the cryptocurrency industry. In addition, some traders may truly want to assist you and provide you with useful suggestions.

However, most of them frequently express their “opinions” to take advantage of inexperienced investors. For example, they might instruct you to buy a specific currency/ coin so that they can exit safely. So, when making financial decisions, only rely on your knowledge and experience.

6. Always keep an eye on Bitcoin

This is both difficult and intriguing. This is crucial to your success. If you understand this, you will buy and sell close to the bottom and top.

If the price of Bitcoin rises dramatically, the price of altcoins may fall as people try to abandon altcoins to ride the BTC profits; conversely, if the price of Bitcoin falls dramatically, the price of altcoins may fall as people quit altcoins to trade back into fiat. Thus, when Bitcoin exhibits organic growth or falls or when its price remains stable, these are the optimum times for altcoin growth.

7. Don’t Be Greedy; Plan your Trading Strategy Visely

No one has ever lost money by making a profit. When a coin begins to grow in value, so does our greed. Why not consider taking a profit if the value of a coin rises by 50%? Even if your targets are set at 70% or 90%, you should still take a percentage of the value on the way up if a coin does not achieve the target. If you wait too long or try to exit at a higher price, you risk losing profit or even turning a profit into a loss. If you want to continue enjoying prospective rewards, get into the habit of taking profits and looking for re-entry.

8. Mid-term and long-term

During your research, you’ll notice that you come across a few different coin classifications. You feel they have fantastic teams, tremendous vision, amazing PR, and a track record of successful execution for some of them. So when the price falls, don’t even think about panic selling because anything in your mid-term or long-term portfolio should be left alone for a defined period of time.

9. Always try to learn from your mistakes

Never accept a complete loss. Always assess the problem and try to determine why it occurred. Then, use that experience to your advantage for your next move, which will be better because you now understand more than you did before. We all started out as novices and have all lost money during our trading careers.

No one is flawless, and no one wins every trade. However, don’t let your losses discourage you because if you want to learn from them, they will make you a better trader.

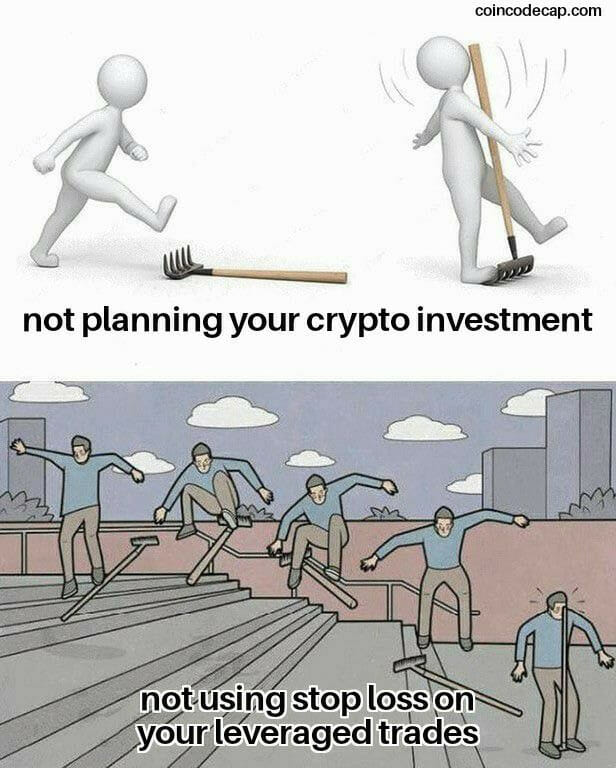

10. Set stop losses if you are an Active Trader

Set stop losses on any coin that is not in your mid-term or long-term holdings. This is crucial for various reasons, the most obvious being loss mitigation. But, more significantly, you force yourself to choose an acceptable loss point, and because you now have a point of reference, you can test your ability to keep or modify it for future trades.

11. Patience

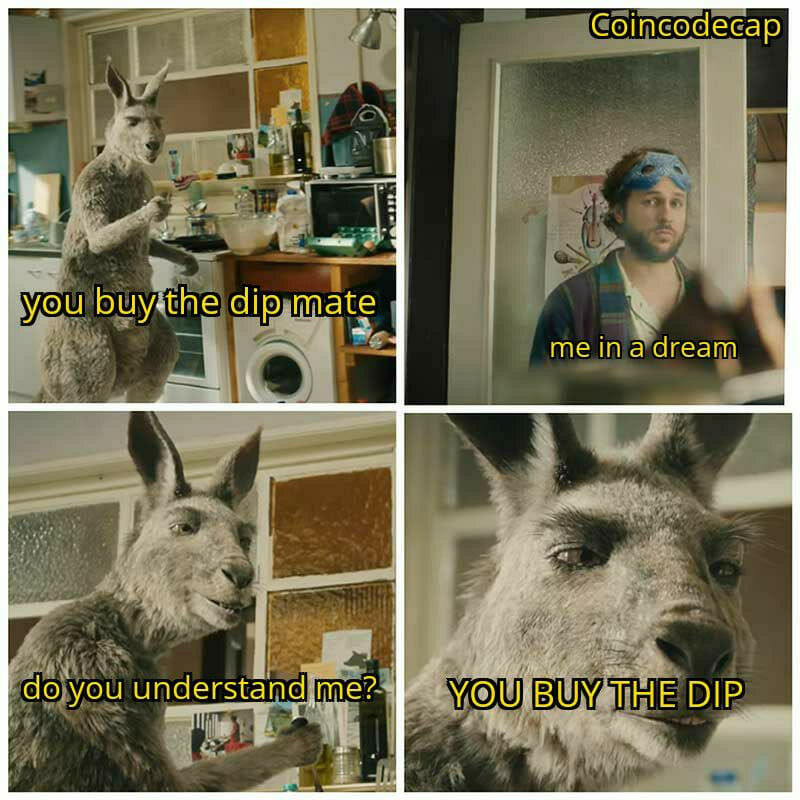

Every successful trader must possess this characteristic. Patience can save a trader a lot of headaches and losses while trading. Patience is linked to some of the emphasized characteristics that traders who want to succeed should cultivate. A patient trader, for example, will not be concerned if the market does not appear to be moving in the desired direction and losses accumulate gradually. Such a person would be aware that the market will still retrace. Such as, the falling market might look to him as an opportunity to accumulate more. Buy The Dip!

12. Always test your strategy

In a detailed article with a few examples, I outlined how you can test your strategy. Please navigate to Simple Steps to Test your Trading Strategy.

Also, Read