GRT or the Graph Token is a utility token of the Graph Protocol, a blockchain data querying protocol. The protocol implements everything so that GRT is used to pay the querry fees, which are further used to reward validators. Therefore, staking GRT can help you earn more of the token than the GRT tokens you hold. There are various ways to stake GRT, and we’ll discuss most of them here, but before getting started, here’s a summary of the article:

Table of Contents

Summary (TL;DR)

- GRT is a token that empowers a decentralized protocol called the Graph.

- Its primary function is to index data from blockchain protocols.

- Anyone can create subgraphs, index blockchain data, and access data from existing subgraphs.

- You need to pay in GRT to query the subgraphs.

- Staking services are now available on most cryptocurrency exchange platforms, such as Binance, Network Beta DApp, and many more.

- Staking can be done both on mobile devices and on desktops.

- An option to unstake your staked GRT is also available; however, the staked tokens can be released only after 28 days from staking day.

- Several risks are associated with staking; hence, it shall be done only after thorough research and gaining enough information about the same.

What is The Graph Token or GRT?

GRT is an Ethereum-based token that empowers a decentralized protocol called the Graph. The protocol indexes and queries data from blockchains such as Ethereum, Fantom, and Filecoin.

Anyone can create subgraphs and index blockchain data while accessing data from existing subgraphs. Moreover, the indexers stake their Graph tokens for security by aligning incentives. Further, the consumers of this blockchain data have to pay querry fees, which are then distributed among the indexers based on their staked GRT.

Before diving straight into it, we must first help you understand some terminologies around earning staking rewards with the graph tokens.

What is Crypto Staking?

The active participation in a proof-of-stake consensus in a transaction validation is known as staking. Different cryptocurrencies have a varying minimum required balances necessary before one validates the transaction and proceeds towards earning a Stake reward.

Furthermore, to be eligible to earn rewards, one must minimize the required balance for that particular cryptocurrency and hold the concerned cryptocurrency on the specific platform or wallet where you would be staking.

Also, read Staking Crypto – An Ultimate Guide on Crypto Staking.

How do network indexers help you earn more GRT?

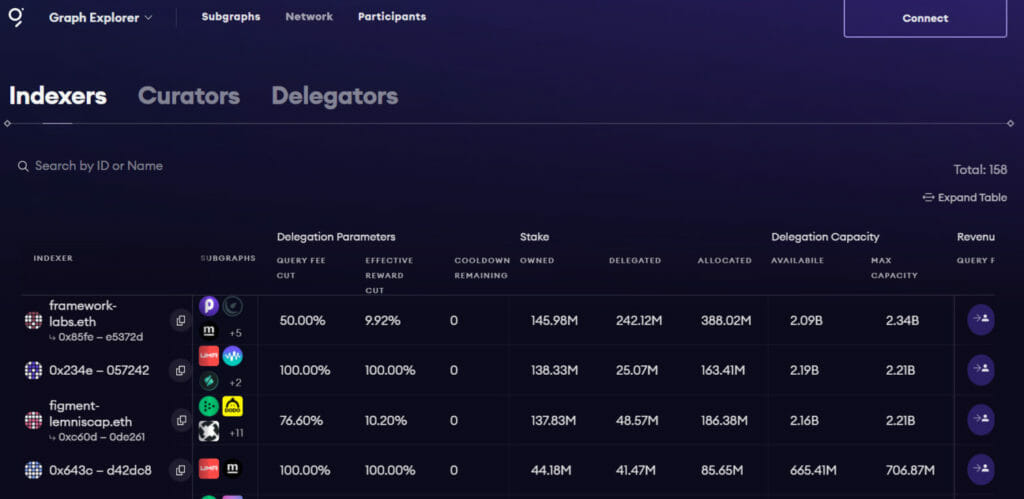

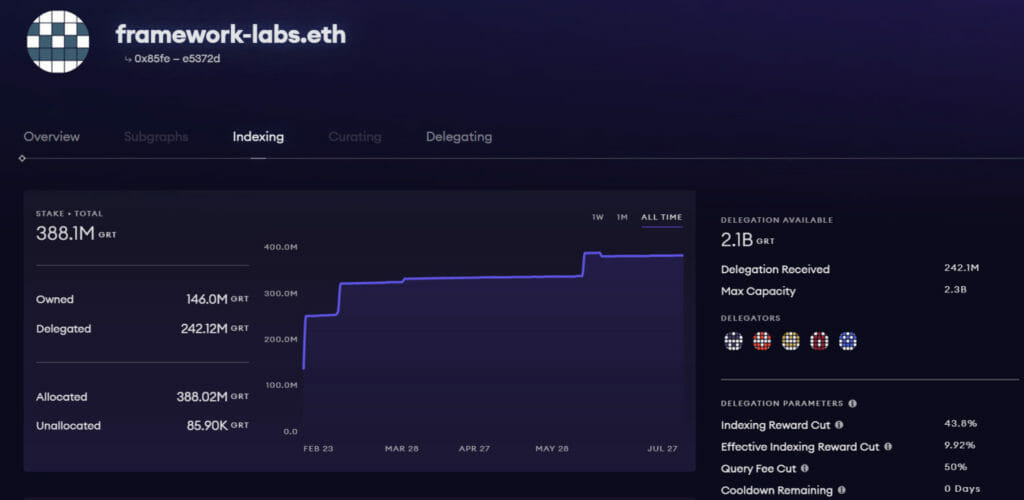

Indexers are the ones who stake the Graph tokens (GRT) and are the node operators in the network. They provide query and indexing services and be delegated stakes from delegators to contribute to their work. As a result, they get query fees and indexing rewards for the services they render.

GRT holders can act as delegators and lock their GRT to earn rewards. A question here might arise as to why do indexers have to stake GRT? Well, Indexers are node operators in the Graph Network who stake GRT to provide the network financial security.

Earning by delegating GRT to Indexers

Delegators are GRT holders who lock their tokens with the indexers to earn interests without actually running a node themselves. By doing this, delegators are entitled to earn a portion of the query fees and rewards the indexers receive for querying blockchain data.

Moreover, there is a delegation fee of 0.5% charged by the protocol. Therefore, before you delegate your tokens, you should calculate the number of days you can earn back that 0.5%, so you don’t up in a loss.

As a delegator, you’d have to pay a delegation fee to an indexer. So the rewards you’ll receive as a delegator depend on the indexer you choose; the higher the percentage cut displayed on the screen, the lower your reward share would be.

Where to stake GRT or the Graph Token?

For all the GRT holders, staking is now an easier task than before. If you want to earn rewards without indulging in the hassles involved in running a node, you may delegate GRT to network indexers. Furthermore, you can delegate or stake your token on the Graph by using Metamask or WalletConnect for any other wallets. Furthermore, using WalletConnect enables you to stake directly from your hardware wallets, such as Ledger, using the Ledger Live app. Hence you will have an added layer of security.

Also, read Ledger Live Review – Best Way to Earn Passive Income.

Cryptocurrency exchange platforms such as Binance and Staked have realized the rise of the Graph and hence have expanded their staking services to include GRT.

Here’s the best way to earn GRT rewards!

With a centralized crypto exchange such as Binance, you can start earning GRT staking rewards instantly. Furthermore, since Binance is the largest exchange, it provides a simple user interface and a decent return on your staked graph tokens while also being able to withdraw your staked GRT at any time.

Steps to Stake GRT at Binance

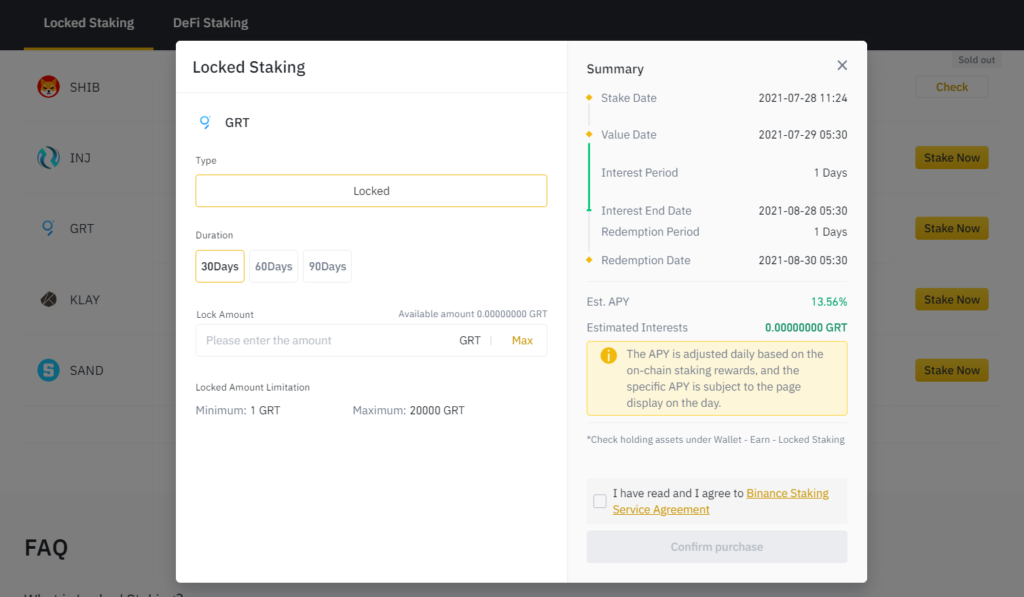

- Sign in to your Binance account using your phone number or email.

- Now, select the “Finance” option and the “Binance Earn” option.

- Come down to the “Locked Staking” option and click on the “View more” button.

- Select GRT from the list of assets you can stake, fix the duration and then click on “Stake Now.”

- Confirm the details of GRT, such as Duration and Available amount.

- Enter the amount you want to stake and click on ” Confirm purchase.”

- To view past locked staking activities, select “Wallet,” then click on “Earn” and select “Locked Staking.”

- You can redeem your assets in advance by selecting the “Redeem Earlier” option. However, you won’t receive the earned rewards if redeemed earlier in case of locked staking.

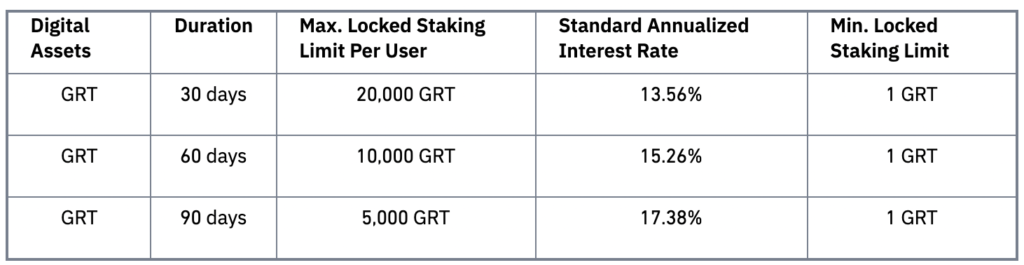

- Max 20000 GRT allows for 30 days of locked staking, Max 10000 GRT allows for 60 days of locked staking, and 5000 for 90 days of locked staking.

- Read more about staking GRT at Binance here.

Pros and cons of taking on Binance

- Pros: It provides an opportunity to earn higher returns. Moreover, it is the safer option.

- Con: Most of the opportunities in staking assets are usually sold out and hence limited.

How to Stake GRT using Metamask?

The growing popularity of staking activities makes it possible to stake GRT using your laptop and mobile devices. It is supported on both Android and iOS and Chrome extension. In addition, you can download the Metamask App as it facilitates you to continue with a safer and more secure Ledger Nano wallet.

Also, read Set up MetaMask for Binance Smart Chain.

Steps to Stake GRT using Metamask

Follow these simple steps to stake GRT using Metamask:

- First, ensure you have the latest version of the Metamask Browser extension and sufficient ETH in your wallet.

- GRT delegation operations need to be set up by you:

- Select the “Add Token” option on Metamask.

- Then, click on the “custom token” tab.

- Fill in your details under Token contract address, symbols, and Decimal precision.

- Select the “Next” option and then click on Add Tokens.

Delegate GRT from the Graph explorer

- Visit the Graph explorer section.

- In the pop-up menu, select “Connect wallet” and “Metamask.”

- Select the address you would like to choose from the Metamask notification window.

- Select the “Next” option and then click on “Connect.”

- Your account can now be seen in the upper right corner of Network Beta DApp.

- Choose an indexer to whom you would like to delegate and click on the delegation icon on the very right of that indexer.

Start managing your GRT trading activities

- You can manage various delegation operations by clicking on your address in the upper right corner of the dashboard.

- You will find an overview of the indexers you are delegating to. Here you can choose to delegate more GRT or undelegate it as well.

Pros and cons of staking using Metamask

- Pros: It has an open-source network; therefore, transparency and clarity are provided to everyone.

- Con: The time taken to process payments and transactions is more than other apps because of its slow speed.

Best Platforms to Stake GRT: A Comparison

- Stake.fish: It is one of the leading staking service platforms in the industry. It provides validation service to the industry’s top proof of stake blockchain.

- Staking facilities: It is a validator, node operator, and service provider with secure physical infrastructure for next-generation blockchain to function. In addition, non-custodial staking services are provided to prove of stake token holders.

- Staked: It is a decentralized network of independent blockchain, which has been powered by a proof of stake-based BFT consensus algorithm.

- Figment: Figment currently serves the world’s largest GRT holders population. It has a multi-cloud staking infrastructure.

- Staking Rewards: It is the leading data provider for staking.

| Stake.fish | Staking facility | Staked | Figment | Staking Rewards | Binance | |

|---|---|---|---|---|---|---|

| APY | 10% | 10%-15% | 15.10% | 15% | 15% | 17.38% |

| Inflation Dilution | 3% | 3% | 3% | 3% | 3% | 3-5% |

| Lockup period | 28 Days | 28 Days | 28 Days | 28 Days | 28 Days | 30 Days |

How to unstake GRT?

You can unstake the tokens that you have staked at any time; however, you might not receive the earned interests if it’s locked staking. Furthermore, after the locking period, generally 28 days, the staked tokens are released. Proceed with these steps if you wish to unstake earlier:

- Go to the specific indexer and select the “Undelegate” option.

- Enter the amount of token that you would like to Undelegate and submit your transaction.

- After the transaction is successful, a reverse timer will start, generally of some more time than the bonding period.

- When the timer gets over, your tokens will be unstaked.

Why should you Stake GRT?

Staking GRT is beneficial in various aspects. Firstly, it provides an opportunity for GRT holders to earn significantly higher APY than traditional cryptocurrency holders. Secondly, there are two kinds of rewards that you may earn during staking. Firstly, the rewards one gets to benefit from staking GRT, indexing rewards. Secondly, a portion of query fees.

The risk involved in Staking GRT

Market volatility is a potential risk factor as the prices can go up or down at any time. The locked coins at a particular time can not be traded, and their prices might decrease.

Secondly, there are chances that you may incur penalties in case the validator node misbehaves. These penalties may impact the overall staking returns. Therefore analyzing a node’s previous performance is of utmost importance before you stake in a particular exchange.

Choosing the right Validator node

Choosing the right Validator node as a trustworthy one would keep your funds secure and help them grow fairly is essential. Therefore, the following points should be kept in mind while choosing a Validator node:

- The amount of time a validator remains available online will determine his reliability.

- Experience and years of operation-

- Before selecting a validator, another vital thing to note is their work experience and years of actively performing this particular task.

- Validators team: Check out the team page and Twitter collaborations of the validator. This would help you know if they had provided services to renowned founders and thus will surely keep your money secure.

To learn more, read Staking Crypto – An Ultimate Guide on Crypto Staking.

Conclusion

The world of digital assets and cryptocurrencies is ever-evolving and changing. Recently, staking has emerged as a profitable and optimum utilization of one’s resources, i.e., GRT coins that are lying idle in your wallet. It facilitates an easy and safe way of earning rewards and other remuneration by simply sitting at home. Hence it is important to gain some authentication and reliable information about the same.

Frequently Asked Questions

Is Staking GRT non-custodial?

Yes, staking GRT is non-custodial. This means that all through the staking process, the funds and private keys will be in your control. After fulfilling the lock-up requirements, you can withdraw funds or unstake/ undelegated whenever you want.

Is staking GRT safe?

Staking GRT comes with its package of risks. Nothing is foolproof, especially in the world of cryptocurrencies. Having said that, what’s life without a few risks! And you can easily earn rewards by staking GRT if you do proper research and take adequate precautions.

Can I stake GRT on coinbase?

Coinbase, one of the most prominent cryptocurrency exchange platforms, has extended its services to include buying, selling, and trading GRT. However, GRT holders still cannot stake GRT on Coinbase.

How to stake GRT on wazirX?

WazirX has suspended all activities related to staking cryptocurrencies. You can still buy, sell and trade cryptocurrencies on wazirX, but you cannot use this platform for staking purposes.