Stock trading has been a major source of income to investors. Hence in this article, we will review Sharekhan Stock trading app and understanding all the nitty-gritty of the platform.

Table of contents

- ShareKhan Review: Summary

- What is Sharekhan?

- Sharekhan App Review

- Trading on Sharekhan

- How to open Sharekhan account?

- ShareKhan Review: Products

- Sharekhan Platforms

- Leverage at Sharekhan

- Sharekhan Referral

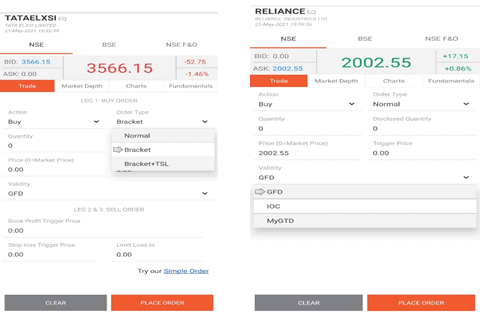

- Sharekhan Review: Order Types

- Sharekhan ReCharges

- Is Sharekhan Safe?

- Sharekhan Review: Pros and Cons

- Sharekhan Review: Conclusion

- Sharekhan Review: Frequently Asked Questions

ShareKhan Review: Summary

- Sharekhan is India’s one of the best stock trading platforms with over 2 Million+ clients.

- You can trade in multiple through Sharekhan Mobile App.

- Sharekhan offers different order types such as Bracket order, trailing stop loss, GFD, etc.

- You can open an online account in fifteen minutes by completing verification at Sharekhan.

- Sharekhan offers different products such as investment charts, pattern finder, smart search, etc.

- You can also use leverage at Sharekhan to magnify your profits. However, leverage also comes with a very high risk.

What is Sharekhan?

Sharekhan (A BNP Paribas group company) is one full-service stockbroker which helps you connect with BSE/ NSE to buy/ sell the stocks and much more. Sharekhan is a stockbroker with over 20 years of experience. This platform has 2 Million+ clients, 3200+ service offices, and INR 46,600+ crore of customer assets.

Sharekhan App Review

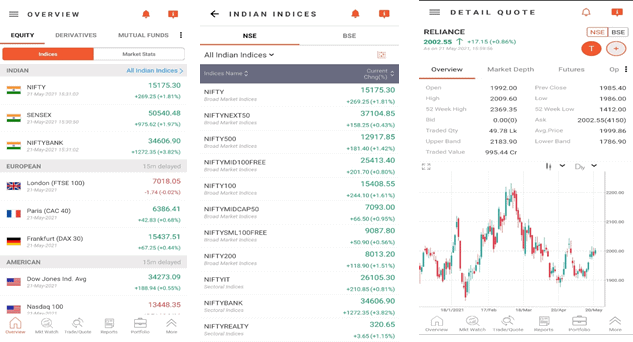

Sharekhan Mobile App allows you to trade or invest in stocks. It has a user-friendly interface and is extremely easy to navigate.

Features

- You can trade in multiple segments through one app. The details are as follows: Equities, Derivatives (Futures and Options), Commodities, Currencies.

- Track movement in Indian and global Indices including Nifty 50, Sensex, Bank Nifty, Dow Jones Industrial Average, Nasdaq 100, S&P 500, FTSE, and Japan Nikkei.

- Create multiple watchlists to track various stocks at a glance or use the existing watchlists available on the app.

- Order book, net position, turnover, trade report, limit statement, and various transaction-related reports are available for the records.

- Live Portfolio shows your current holdings. Virtual Portfolio helps you to create a dummy portfolio using live market information. Hence, you can test strategies and then apply them in live scenarios.

- You can apply directly in IPO (initial public offer), bonds, and OFS (Offer for sale) with the app.

- Sharekhan also provides the market news.

- It enables you to transfer funds, i.e., you can withdraw or allocate funds.

Trading on Sharekhan

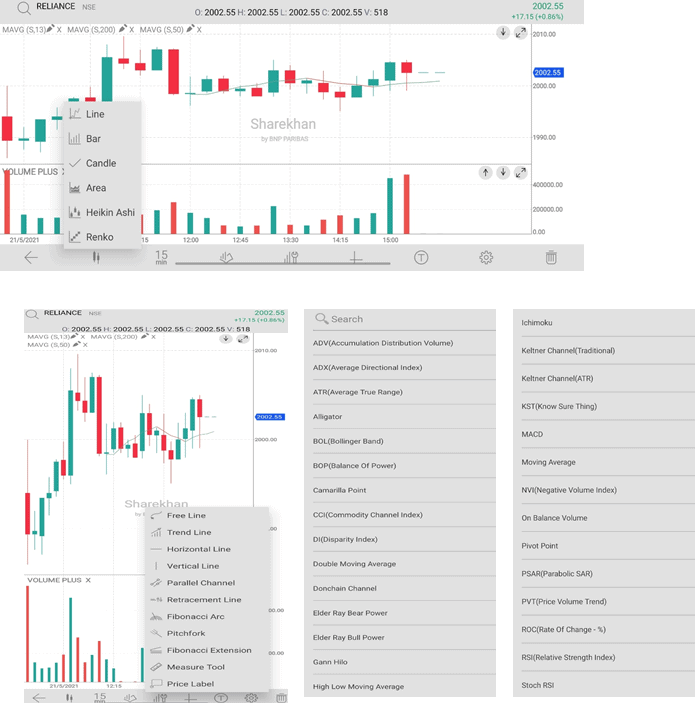

Sharekhan app provides best in class charting features for technical traders like:

- 6 types of charts, which include a candle bar chart.

- 17 different time frames.

- 36+ Indicators including MACD, moving averages, RSI, etc.

How to open Sharekhan account?

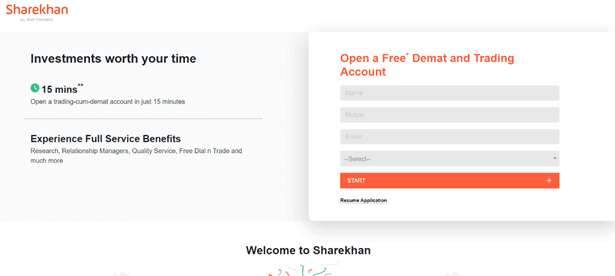

You can open an online account in fifteen minutes by visiting Sharekhan‘s Website. Keep the essential details and soft copies of KYC documents handy while creating an account.

Sharekhan allows you to open an account by creating a request on the website. Later, an RM will visit your instructed address to open the offline account.

Step 1: Sharekhan Email Verification

Enter name, mobile number, email address, city, and click on start. Then, verify with the OTP received on your mobile number.

Step 2: Sharekhan KYC Verification

You need to provide the following details for your KYC verification:

- PAN

- DOB

- IFSC Code

- Bank Account Number

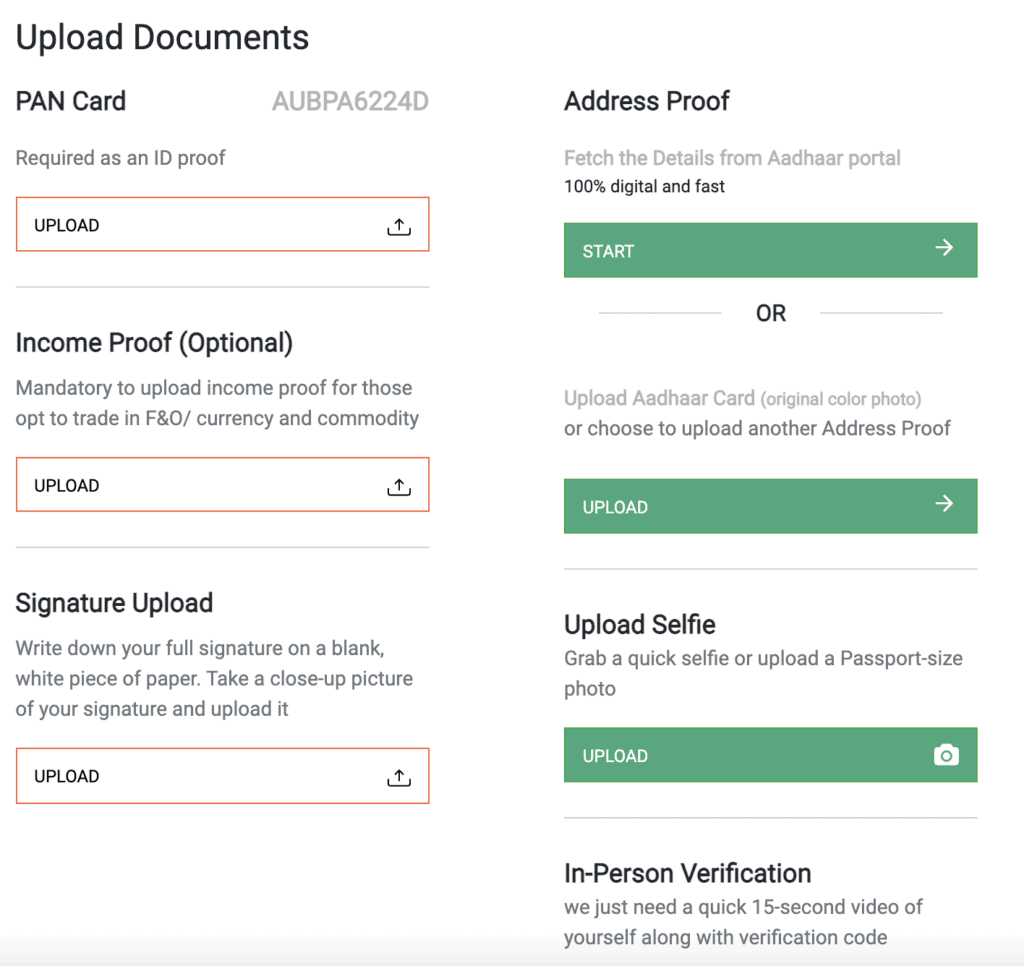

Step 3: Upload Documents

These are the following documents that you need to upload:

- PAN

- Address Proof

- Cheque Copy

- Income Proof (Preferably Income Tax Return- it is mandatory if a users want to activate the derivatives segment for trading)

- Signature Copy

- Click a Selfie to upload

- Record a video for face verification

Step 4: Additional Details

These are some additional detail that you have to share:

- Gender

- Marital Status

- Income Details

- Trading Experience

How to add money to Sharekhan?

You can only transfer funds from your registered bank account to Sharekhan. Notably, you can fund through NEFT, RTGS, net banking, or UPI. There are no charges for adding funds to the account. Similarly, there are no charges on withdrawals. You need to specify the section in which you want to add funds. Hence, you have to choose from equity or mutual funds. Later on, you can inter-transfer funds between equity, IPO, mutual funds.

How to use Sharekhan?

These are the steps that you can follow to place an order at the Sharekhan app:

- Place your order through BSE/ NSE (Action: Buy/ Sell).

- Then choose your order type from normal order, bracket order, or bracket + TSL.

- In the next step, you may choose to specify the price. If you select the price, it is a limit order; else, your order is executed with the best available price in the market.

Day Withdrawal Fulfillment Timing at Sharekhan

| Day | Withdrawal Timing | Fulfillment Timing |

|---|---|---|

| Monday – Friday | Before 10:15 Hrs. | Same Day Afternoon |

| Monday – Friday | Before 14:00 Hrs. | Same Day Evening |

| 1st, 3rd & 5th Saturdays | Before 10:15 Hrs. | Same Day Afternoon |

| 1st, 3rd & 5th Saturdays | Before 14:00 Hrs. | Same Day Evening |

| 2nd & 4th Saturdays/ Bank holidays | – | No Payout (Considered for next working day) |

ShareKhan Review: Products

- Investment Chart: Users can build a portfolio/ group of their favorite stocks and trade them with a single click. You can monitor Investment Cart stocks without logging in.

- Pattern Finder: This product works best for Technical Analysts. Pattern Finder recognizes critical technical patterns and shares trade ideas to generate profit.

- Smart Search: An intuitive search engine built by Sharekhan that allows instant search across scripts, related news, research calls, users’ current holdings, positions. It also locates mutual funds with relevant star ratings, returns, funds, other details, and much more.

- NEO: It’s an intelligent goal-based investment tool. Users can invest in an automated manner in mutual funds based on their risk profile, goal, and time horizon.

- Alerts: It enables instant alerts over SMS and email set for price movements, corporate announcements, board meetings, news, etc.

Sharekhan Platforms

Sharekhan offers multiple platforms that cater to different needs of investors/ traders. The media are given below:

- Sharekhan web is a web browser interface for traders to invest in stocks using a desktop.

- Sharekhan Mini is a mobile or browser-friendly website. It gives a seamless experience to users with low or unstable internet connectivity.

- Tiger Trade: Pro and seasoned traders use the advanced trading platform for desktop called Tiger Trade.

- Sharekhan dial and trade allow users to place trading orders via telephone. These phone calls are free.

Leverage at Sharekhan

Traders can use leverage to magnify the profits and use their limited capital efficiently. Look at these types of leverage.

- Investors with existing holdings of stocks can pledge and take new trades for up to 5 days. Therefore, this is ideal for traders or investors with a short-term position in mind.

- EMF (Exchange Margin Funding) allows users to buy stocks on borrowed capital with a partial capital investment (margin) of their own at 15-24% interest rates from the stockbroker. This allows the investor to hold on to their position. Moreover, users can benefit from price movements in their stock holdings only with a portion of their capital in the total investment.

- LAS (Loan Against Securities) allows investors to take a loan on their existing qualifying securities at a 9.5-12% interest rate. The user must pay interest monthly. Lastly, no prepayment charges or lock-in charges are levied.

Sharekhan Referral

You can ask your friends or share the referral code to other people. Once these referrals start trading or investing, the referrer earns up to 15% brokerage on such transactions.

Sharekhan Review: Order Types

What is Bracket Order in Sharekhan?

With bracket orders at Sharekhan you can execute the buy/ sell transactions, book profits in bracket order, and limit losses. The order will be completed only when the market reaches the profit book price or stop-loss price.

For example, suppose you buy XYZ stock at INR 100 and keep the profit book price at INR 110 and stop-loss at INR 98. In that case, your sell order will be executed when the market price reaches either INR 110/ 98. In this way, you can book your profit of INR 10 or limit your loss to INR 2.

How to use Trailing Stop Loss in Sharekhan?

Trailing Stop Loss allows you to trail your stop-loss price when the market favors you. For example, when you buy a stock and its price is continuously rising, you would want to wait to book your higher profits. Therefore, you can move the stop loss at INR 100 or a greater price as the market keeps going up.

What is GFD in Sharekhan?

The order will be valid until the market hours are over for the day or until executed, whichever is earlier.

What is MyGTD in Sharekhan?

The order remains valid until your said date (max 30 future days are allowed) or execution, whichever is earlier.

Sharekhan ReCharges

You need to open a Demat and trading account for dealing with stocks. This exchange provides a free trading account with zero Annual Maintenance Charges (AMC). Sharekhan waives off Demat account AMC for the 1st year. The brokerage charges for delivery-based transactions; for the cash segment is 0.30% of the trade value, subject to a minimum of INR 0.01. The brokerage charges for intraday transactions are 0.02%, subject to a minimum of INR 30. Demat AMC charges from the second year are INR 400.

Is Sharekhan Safe?

Sharekhan uses 2FA, and you must set 2 types of passwords- membership and trading password to log in and execute transactions, respectively. Additionally, it is mandatory to reset the membership password every 30 days.

Sharekhan Review: Pros and Cons

| Pros | Cons |

|---|---|

| Sharekhan provides advisory and research assistance to make informed investing decisions. | The brokerage charges are higher as compared to discount brokers. Still, they are compensated with the host of services Sharekhan provides. |

| Once an account is created, the user gets the browser version and the mobile application, and other complementary services of research-based calls. | |

| Sharekhan has created 7+ watchlists to track instantly. |

Sharekhan Review: Conclusion

Sharekhan is one of the best stock trading platforms in the country. It provides a lot of services and is a great option for investors. You can use bracket order, trailing stop loss, etc., to optimize your trading experience. Investors with low capital and infrequent investments should prefer discount brokers over full-service brokers. One should look at his requirements and accordingly choose his stockbroker. However, Sharekhan is suitable for every type of investor looking for opportunities in the stock market.

Sharekhan Review: Frequently Asked Questions

How to sell shares in Sharekhan?

You can head over to the market tab and enter the number of stocks you wish to sell. Finally, hit the sell button to complete the order.

What is the trigger price in Sharkhan?

The trigger price at Sharekhan is similar to the stop loss. If the market goes in the opposite direction and reaches your stop loss, your trigger price hits, and the position is sold at the specified loss.

What is Order validity at Sharekhan?

The order validity means that the order will be executed as soon as the desired prices are available in the market. GFD or Good-For-Day is the validity period of the orders.