This article will discuss the Quadency’s Accumulator bot that follows the DCA strategy. We will also go through the Quadency platform, DCA, and how to use the accumulator bot to apply the DCA strategy.

Table of contents

Quadency Overview

Quadency is a professional multi-exchange crypto asset management platform. Users can link their existing exchange accounts with Quadency to get a complete view of their holdings and also be able to send purchase or sell orders directly to the top crypto exchanges.

Once an account is connected, users’ balances, trades, and orders are automatically synced to calculate their live and historical portfolio statistics and allow them to trade using the trading tools. Quadency also provides 12 trading bots to automate trading based on pre-defined strategy. Accounts from Coinbase Pro, Binance, Bittrex, and other exchanges can be easily connected with Quadency.

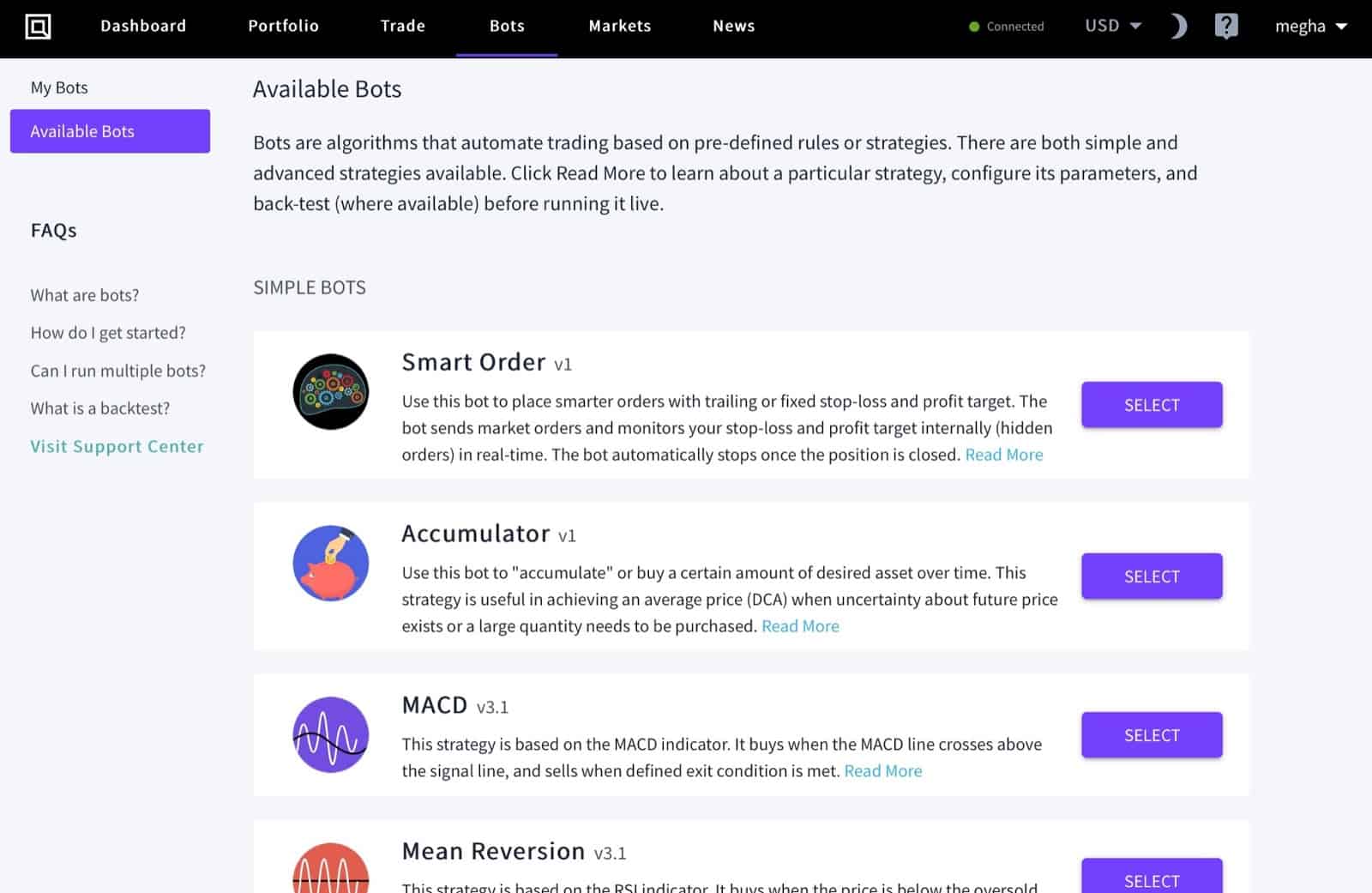

Trading bots provided by Quadency –

- Smart Order

- Accumulator

- MACD

- Mean Reversion

- Bollinger Bands

- Multi-Level RSI

- Market Maker

- Portfolio Rebalancer

- Grid Trader

- Market Maker Plus

- TradingView Bot

- Strategy Coder

Accumulator bot uses DCA strategy, therefore, we will discuss the Accumulator bot in depth. If you want to know more about platform, read our Quadency Review.

What is Dollar-Cost Averaging (DCA)?

DCA stands for Dollar Cost Averaging. This is an investment strategy in which investors invest their funds periodically. For example, Investor A is having $1000 and wants to purchase a bitcoin of $1000. Instead of buying a bitcoin of $1000, he will buy a bitcoin of $100 every week. The main idea behind this strategy is to divide funds into smaller chunks to invest periodically. This is one of the safest investment strategies in the market.

Quadency’s Accumulator bot

Quadency has provided an automated trading bot for investment that follows the DCA strategy where investors don’t need to make orders manually. This bot is used to “accumulate” or buy a particular amount of asset over time.

Users can use this bot to split up a large order over time and send a maximum of 1 order per minute. The total time until when the bot will run can be a few minutes to years – it’s totally up to you how you want to use it. Users just need to create a bot and give some parameters value required to execute DCA strategy, and everything will be taken care of by the accumulator bot. We will discuss all input parameters while going through the step on how to use them.

How to use Quadency’s Accumulator Bot?

Step 1: Sign up on Quadency

First, you have to sign up for Quadency if you don’t have an account. After signup, login again.

Once successful login, it is advisable to enable 2FA to log in from any device. Otherwise, it will send an approval mail each time when you log in from any new devices.

Step 2: Open the Accumulator Bot

- Go to the Quadency platform.

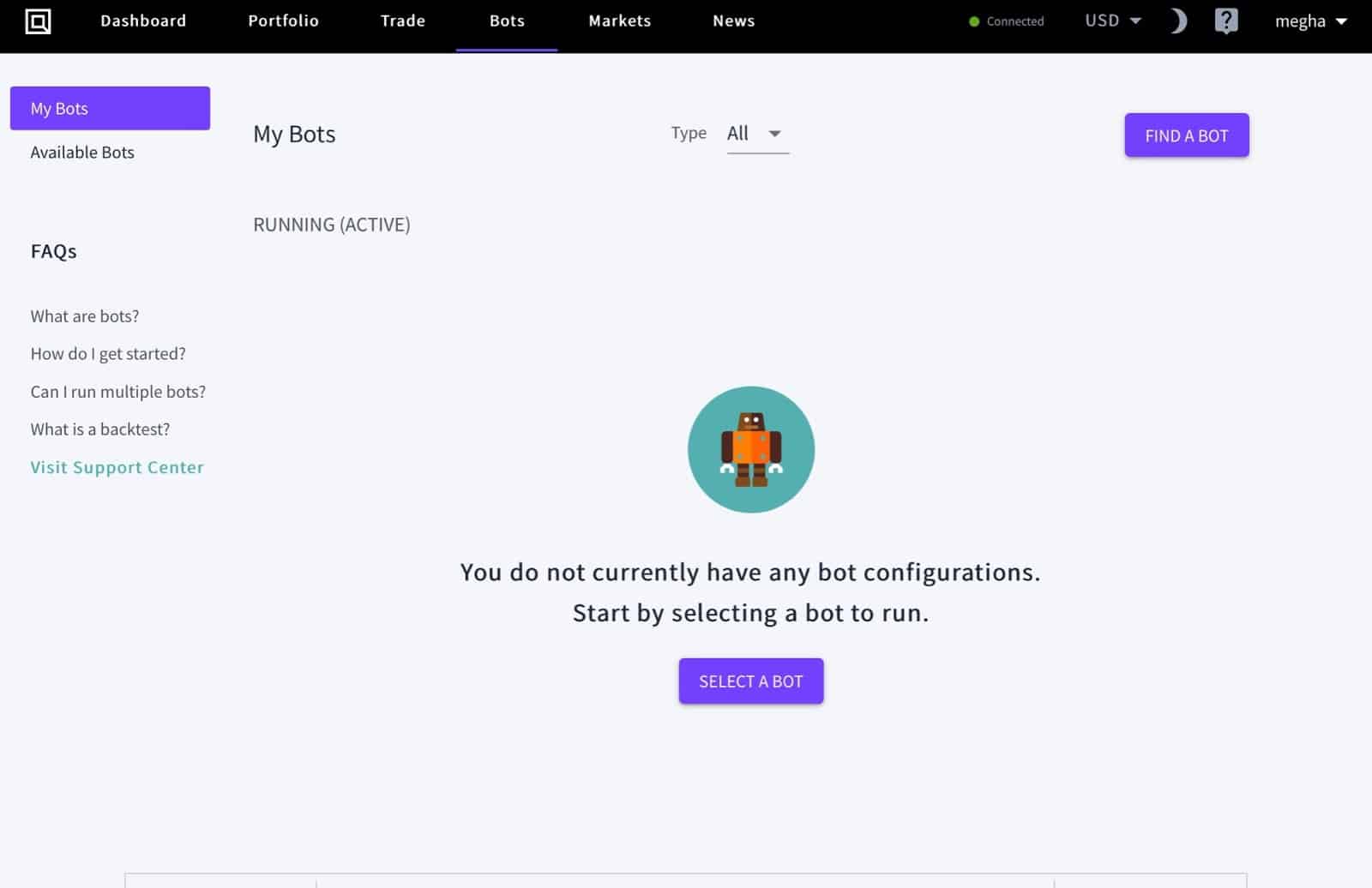

- Click the “Bots” tab from the navigation bar. This will list all the running(active) bots and allow you to create bots.

In the above image, there is not any active bot.

- To create a bot, click “SELECT A BOT”. This will list all the bots that are available to use. There are both simple and advanced strategies available.

- Select “Accumulator” bot.

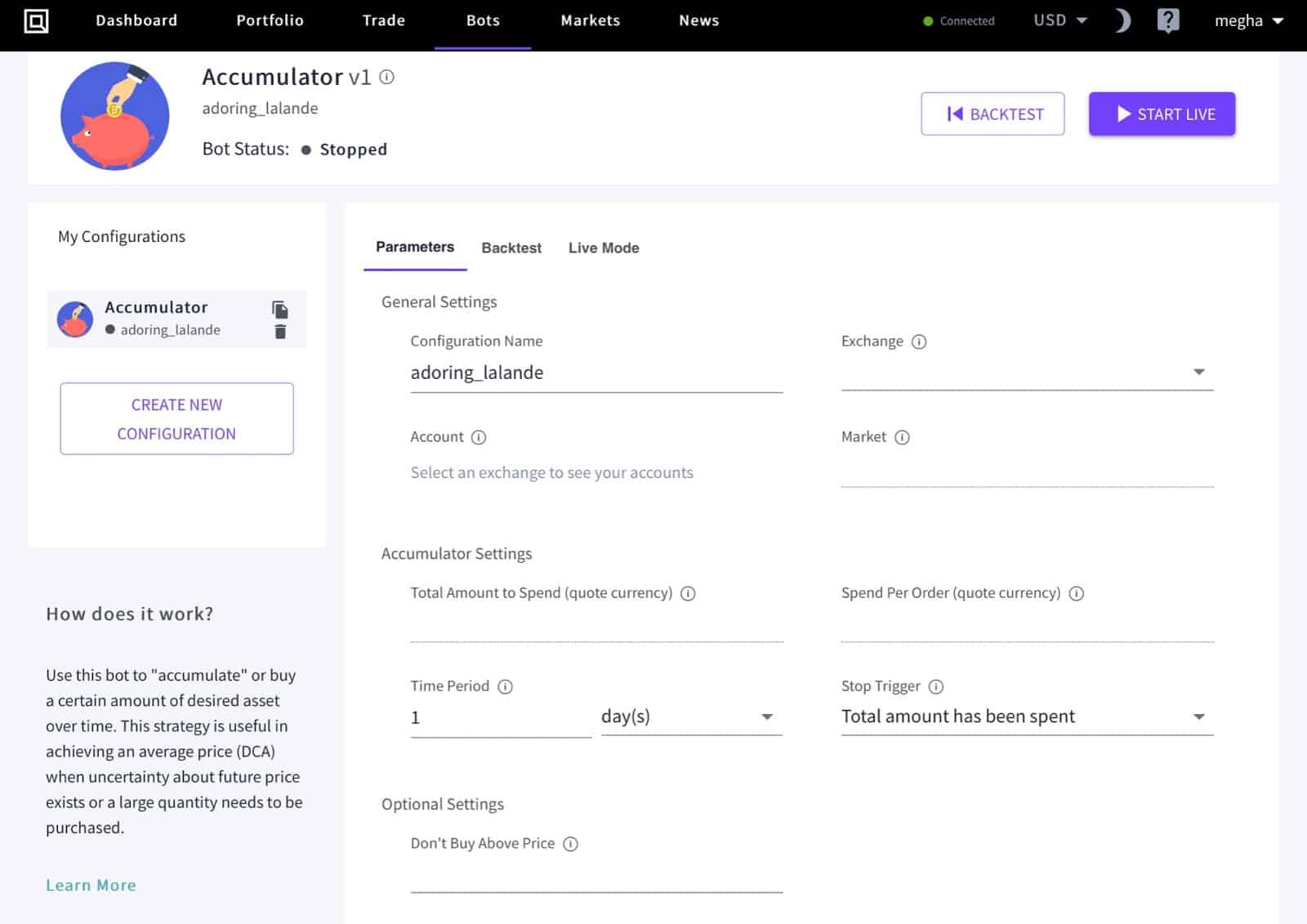

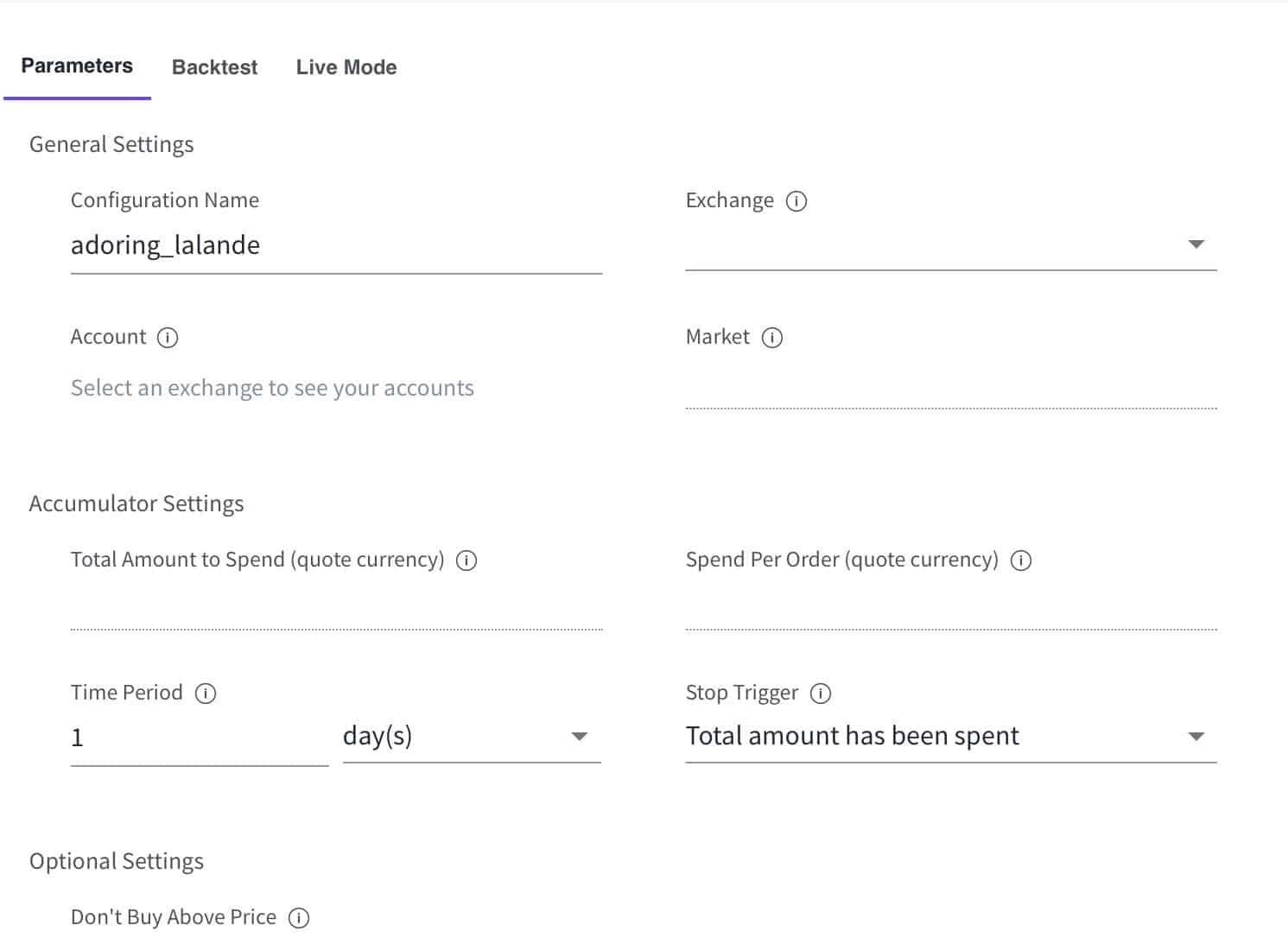

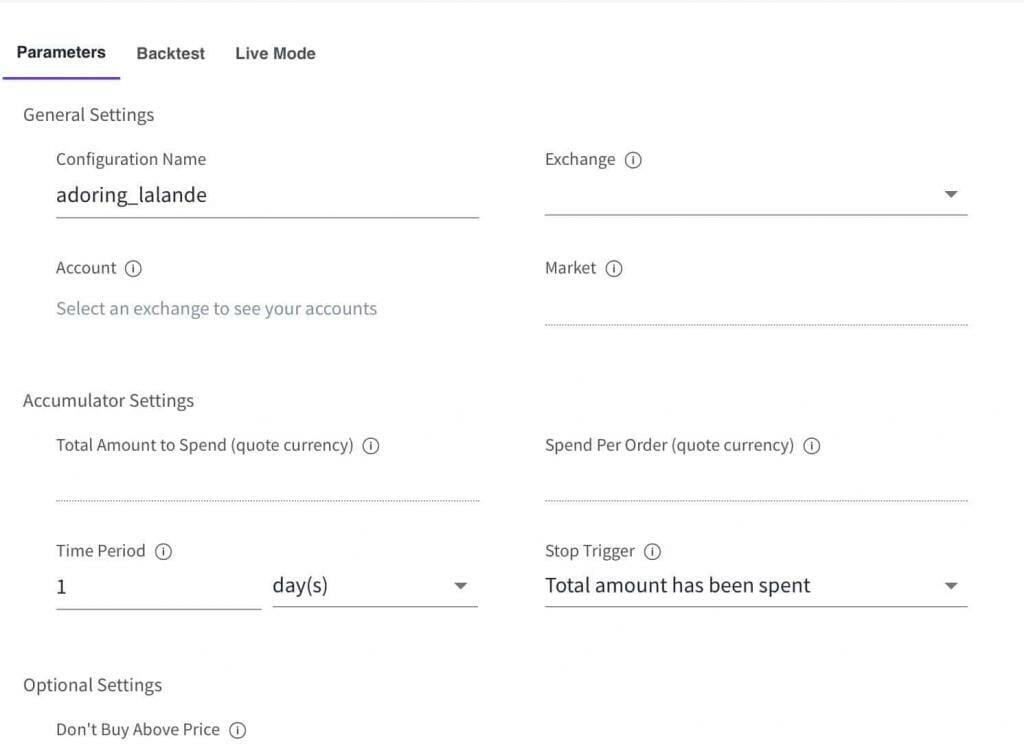

It will ask for some parameters to create an Accumulator bot, as shown in the above image. We will discuss all parameters in-depth in the next step.

Step 3: Accumulator Bot Configuration

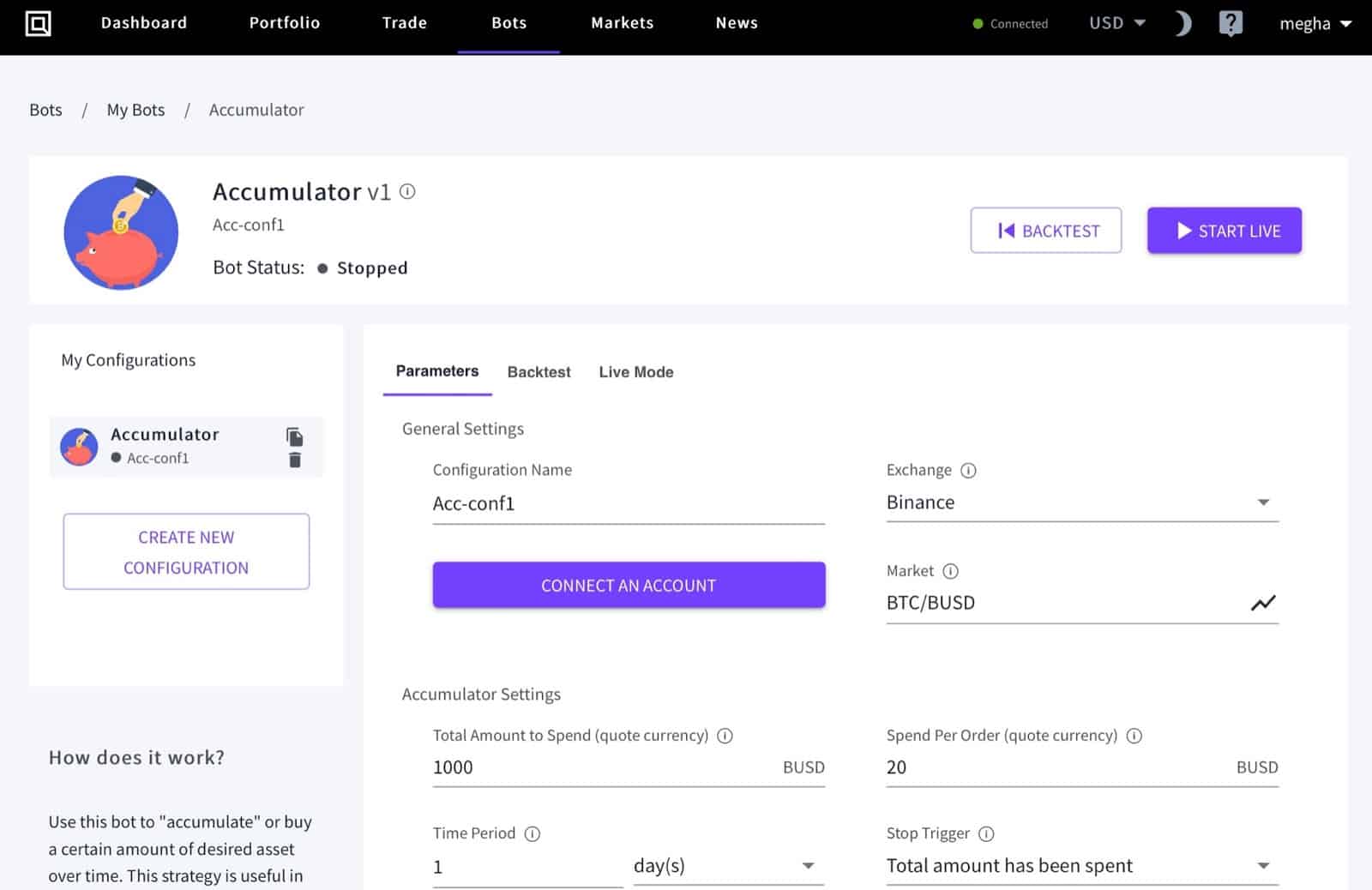

The above image shows all the parameters that we need to configure. Let’s discuss them step by step.

- Configuration name: Give a name to this configuration of parameters. This helps to use the same configuration for the next time.

- Exchange: Select an exchange where you are holding cryptocurrencies and want to automate trading. Accumulator supports AAX, Binance, Binance US, Bitfinex, Bittrex, Coinbase Pro, Gemini, HitBTC, Kraken, KuCoin, Liquid, OKEx, and Poloniex.,

- Account: Connect account in which bot will make purchases. After providing exchange details, you can connect your account by providing an API key and secret key.

- Market: This is a trading pair in the format of Base/Quote. For example, BTC/BUSD means you want to buy BTC in exchange of BUSD.

- Total amount to spend: This is the total amount you want to spend. Define this amount in the quote currency. For example, you are buying BTC in exchange of BUSD, so the total amount should be in BUSD.

- Spend per order: This is the amount that the bot will spend on each order. For example, define 20 BUSD if you want your bot to buy 20 BUSD worth of BTC in each order.

- Time period: This is the length of time the bot will run. For example, if you want your bot to buy 20 BUSD worth of Bitcoin (BTC) every day for one month, then specify one month.

- Stop trigger: The value here determines when the bot should stop buying. There are two options: Over Time Period and Total Amount to Spend. If you select “Over Time Period”, the bot will stop buying when the time allotted to the bot has elapsed, even if the total amount purchased has not been completed. If you select “Total Amount to Spend”, the bot will continue buying until the total spend amount has been exhausted, even if the bot has to run beyond the time allotted. Use one of these options to control the behavior of this bot per your discretion.

- Don’t buy above price: This is the amount in quote currency that specifies the boundary. If the specified market price gets higher than a set amount, the accumulator will not purchase.

The number of orders is automatically calculated based on the time period the bot will run. From the above scenario in the image,

Total Amount = 1000 BUSD

Spend per order = 20 BUSD

Total time = 1 Day (24 Hours)

So, Amount to spend per hour = 1000 BUSD / 24 Hour = 41.66 BUSD

No of orders per Hour = Amount to spend per hour / Spend per order = 41.66 / 20 = ~2

I configured the Accumulator bot to buy 1000 BUSD worth of BTC over 24 hours; at 20 BUSD per order, the bot will send ~2 orders per hour until the stop trigger specified is met. If the price of BTC goes higher than 62000 BUSD, a bot won’t send an order.

Step 4: Backtest and Start Accumulator Bot

- After configuring a bot’s parameters, users can backtest. Backtest is a way to simulate a strategy’s performance using historical data before committing real funds to a bot for live trading. Backtesting estimates the performance of the selected strategy by using historical data. It assumes that if the strategy worked previously, it has a good chance of working in the future; conversely, if the strategy has not worked well in the past for a particular market, it may not work well. To backtest, Click on “BACKTEST”.

- To make this bot live, click on “START LIVE”.

Now, the Accumulator bot will make orders automatically as per passed parameters.

Quadency Dollar-Cost Averaging Bot: Conclusion

Dollar-Cost averaging(DCA) is an investment strategy in which users divide investment amount into smaller chunks and invest it periodically. Quadency’s Accumulator bot follows the DCA strategy for automated investment. Accumulator bot configuration required around 8 to 9 parameters to start it. While configuring it, you can also select a stop trigger to stop a bot. Before making it live, you can back-test the performance of configured accumulator bot.