Cryptocurrencies like Bitcoin have a history of price volatility compared to traditional currencies like the US dollar. Some cryptocurrency users find a need to trade for more stable options under circumstances, such as avoiding risk for example.

In response to cryptocurrency’s variable price movement, digital currencies with a stable price compared to USD have been created. The most popular one by market cap is Tether, USDT.

A concern with Tether is that USDT is minted by a centralized platform. Some question on transparency, if Tether truly has the collateral of USD that makes their price stable.

In response to centralized stablecoin offerings that may lack transparency, MakerDAO created a stable coin whose supply is made in a transparent and decentralized manner.

Money Made from Debt

Collateral is something of value that is given to a lender in case someone borrowing cannot pay back their loan. If you were to buy a house, the collateral for your mortgage would be the house. If you couldn’t pay back your mortgage, your lender, in most cases a bank, can take your house away.

MakerDAO’s stable coin DAI is printed when collateral is locked up. Locked assets are redeemable for a value close to its price in DAI. DAI is pegged to USD, meaning, the price of one DAI to one US dollar.

But DAI is debt.

To create DAI, collateral must be locked. To unlock this collateral, the DAI must be paid back. In this way, the DAI being created is a loan that must be paid back.

For the collateral to be considered safe, the value of the assets creating DAI must be worth more than the monetary value of DAI. The DAI must be overcollateralized.

If the price of the underlying asset falls, the DAI created can be under collateralized. If DAI is collateralized, that collateral is considered unsafe.

Once the collateral for printed DAI is unsafe, the collateral is liquidated, and available to anyone via auction. The collateral may be bought at a discount this way.

This system of having an asset redeemable at both a premium and a discount under certain cases puts the price of DAI to one US dollar. And the creation of this money is through borrowing.

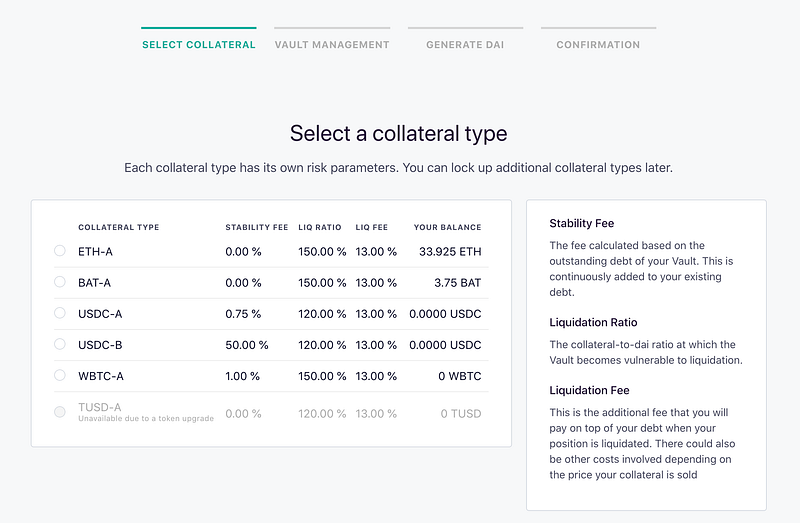

Collateral for DAI started as ETH, but now includes Wrapped BTC, USDC, and USDT.

Leveraged Positions from Debt

Why would anyone create this debt in the first place? The reason is you can earn value by using debt as a leveraged long position.

A long position means you are using borrowed money to make more money if the price of an asset goes up. If you long Bitcoin, for example, if the price of Bitcoin goes up, you make more money by longing than by holding the asset.

How you do this with Maker, you start by owning the asset you’d like to long. Currently, Maker supports ETH, WBTC, USDT, and USDC. But for someone who would like to long, the options are WBTC (Bitcoin), ETH, and BAT.

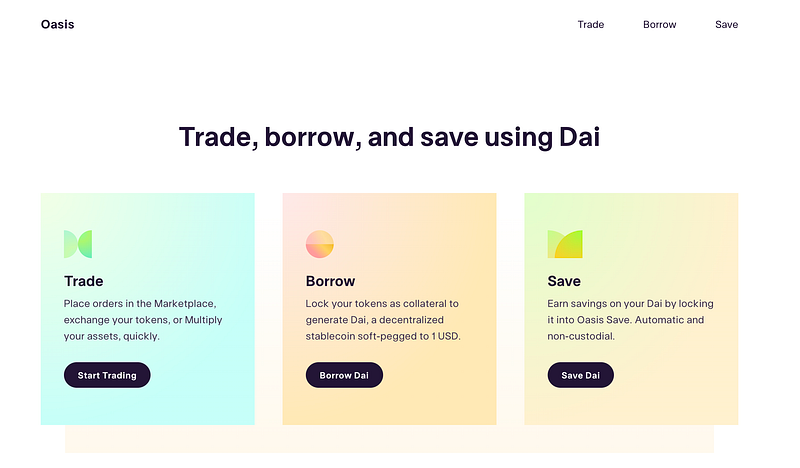

Start by going to Oasis.app.

From there, go to “Borrow.” This is where you’ll be able to create DAI.

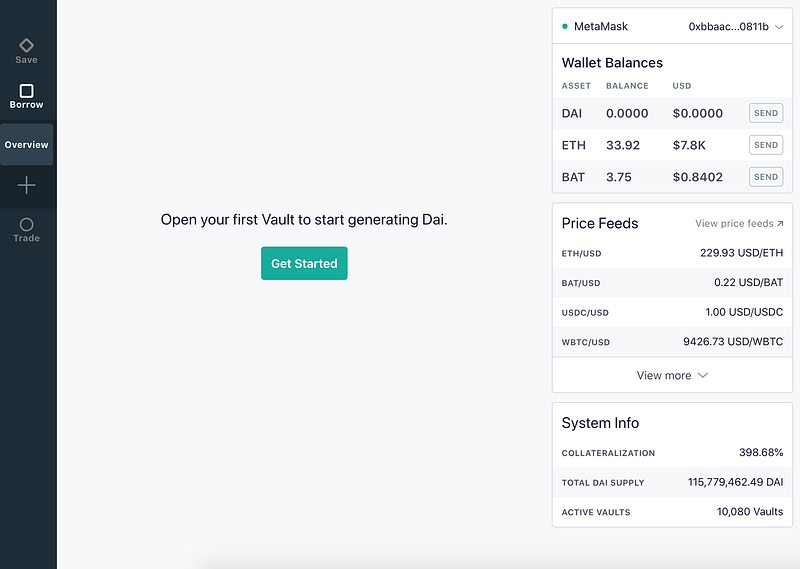

To create DAI, press “Get Started.” A page should open asking what asset you’d like to use as collateral to create DAI.

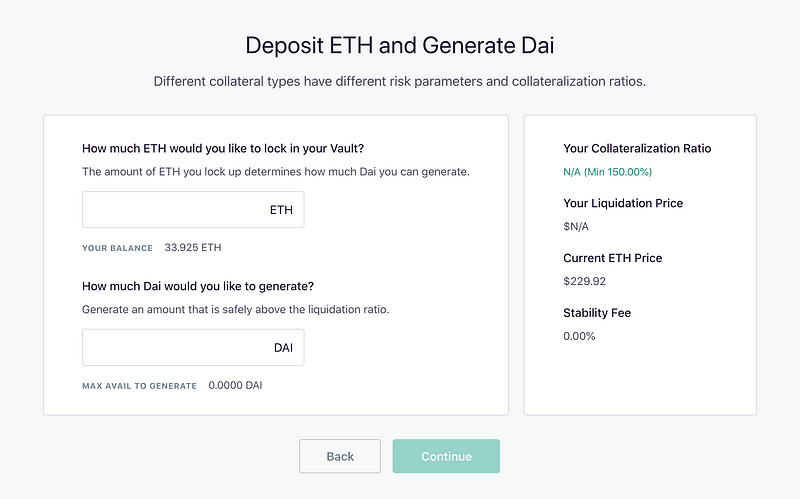

Next, we can choose how much of the asset we’ll lock up, and how much DAI to create. The lower the proportion of DAI to the asset, the safer the asset is against being liquidated if the asset falls in price.

Once the DAI is created, you’ll be able to do what you want with it.

If you’d like to long the asset you put as collateral, trade the DAI for that asset. If that asset increases in price, you can sell it for the DAI you need to pay back and will be able to pocket extra of that asset.

- Examining Reddit’s Rumored Ethereum Token

- An Overview of Binary Options Trading

- What is Bitcoin and How Bitcoin Works?

- Different Types of Crypto Trading Bots

- Bitcoin Halving: The Public Perception and Charts

- How to buy Bitcoin using PayPal?

- Common Crypto Questions

- Top 6 Softwares for Managing Bitcoin Mining

- 2020 Investor’s Guide to Crypto