You’re paying twice the amount you paid last year for the same amount of food. Ignorance of the rising inflation has led us, the commoners to spend way more than we used to and has kept draining our savings throughout history.

Key Takeaways

- Ignorance of the rising inflation rates among people can be observed as US inflation hit a three-decade high in October.

- Americans are paying higher prices for groceries, gas, and holiday gifts.

- Almost 40% of total US dollar in circulation was printed in the last one year.

- According to the Labor Department, the consumer price index, which measures how much people pay for goods and services, increased by 6.2% in October.

- Moreover, according to a study, an average man has to double his budget to dine in an restuarant when compared to last year.

Due to persistent supply shortages and strong consumer demand, US inflation hit a three-decade high in October. It delivers widespread and significant price increases to households for everything from groceries to cars. Yet, even though Americans are paying higher prices for groceries, gas, and holiday gifts, many continue to live and spend as if this isn’t the case.

What does the Government say?

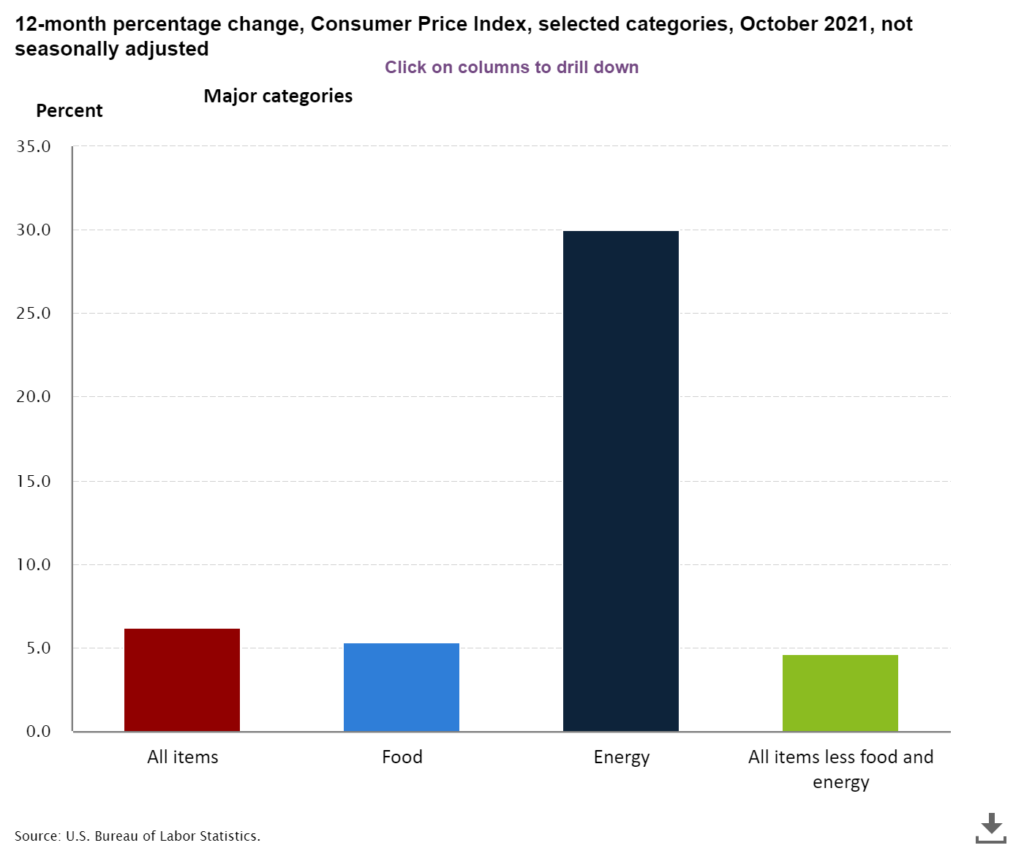

According to the Labor Department, the consumer price index, which measures how much people pay for goods and services, increased by 6.2% from a year ago. That was the fastest 12-month rate, and it was the fifth month in a row that inflation exceeded 5%. The index measures inflation, primarily determining how much it costs an individual to buy everything they require in life.

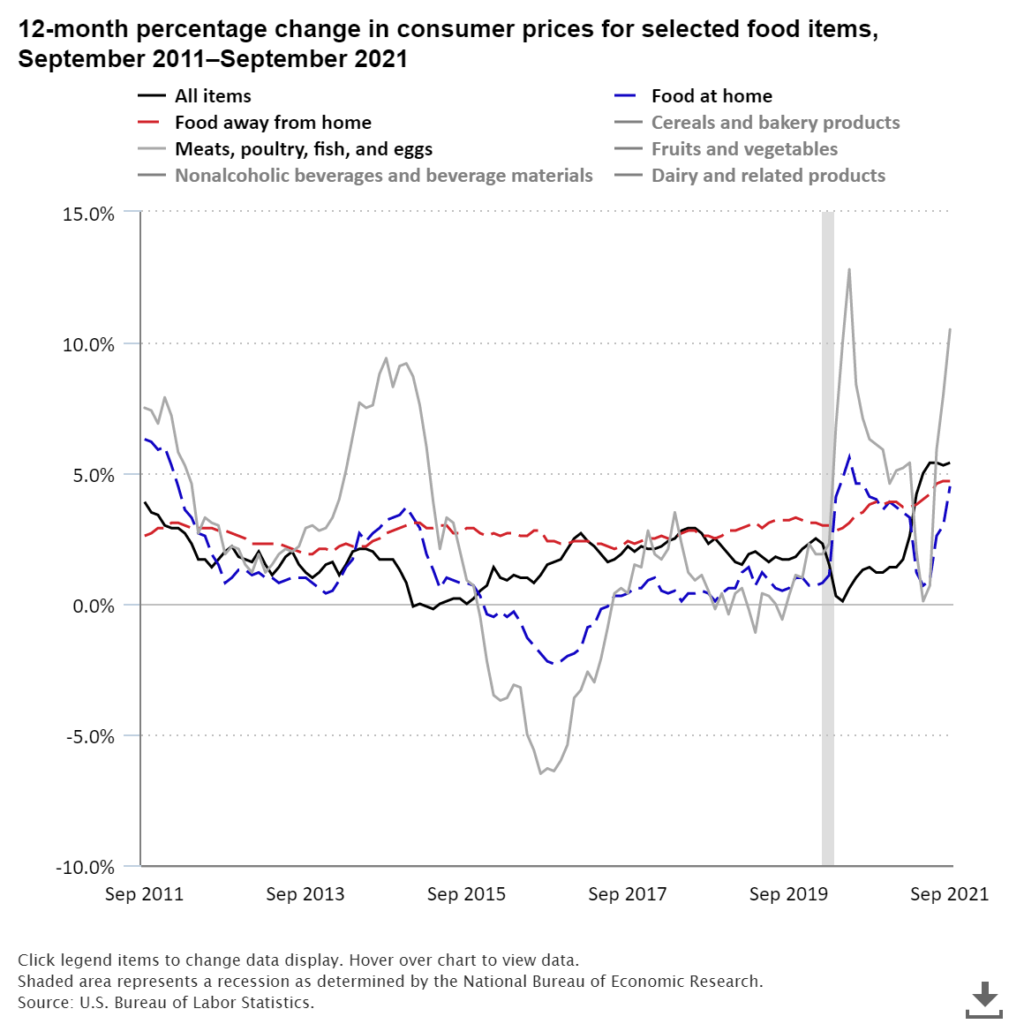

The core price index, which excludes the often-volatile food and energy categories, rose 4.6 % in October. According to the Labor Department, price increases were widespread, with higher costs for new and used cars, gasoline and other energy costs, furniture, rent, and medical care. In addition, food prices have risen to their highest levels in decades, both for groceries and dining out. On the other hand, airline tickets and alcohol have both dropped in price. As investors digested the impact of price pressure on the global economy, US stocks fell, and bond yields rose.

Despite the increase, consumer spending increased by 0.6% in September, according to Bureau of Economic Analysis data. In addition, according to the Federal Reserve Bank of New York, credit-card balances increased by $17 billion in the third quarter. At the same time, new vehicle sales have slowed from last year.

What’s happening?

Consumers’ wallets are being hit by persistently higher inflation, which has been triggered by a faster-than-expected but uneven economic recovery, trillions of dollars in pandemic-related government stimulus, and other factors. At the same time, a strengthening economy and strong household balance sheets are boosting demand while also cushioning price hikes.

The surge in inflation complicates the Federal Reserve’s strategy for unwinding the easy-money policies. It was imposed by the central bank early in the pandemic. It has also emerged as a political factor influencing the economic agenda of the Biden administration.

The reading re-enforced Republicans’ criticism of Democrats’ roughly $2 trillion social spendings and climate plan as wasteful and likely to fuel inflation. The plan includes funding for expanded child care, free prekindergarten, an expanded child tax credit, and other items, as well as prescription drug price reduction provisions.

Prices rose fastest in the South, a country region that reopened earlier in the pandemic but was hit particularly hard by the Delta variant of Covid-19. In addition, prices rose more in the Midwest than in the Northeast and West.

Fed officials are closely monitoring inflation indicators to determine whether the recent price increase is temporary or long-term. One such factor is consumer expectations of future inflation, which can be self-fulfilling because households are more likely to demand higher wages and accept higher prices in anticipation of further price increases.

Consumer spending increased at an annual rate of 1.6% in the third quarter, a significant slowdown from the prior quarter’s 12% increase. However, much of that slowdown was caused by a lack of new cars and other durable goods. Consumer spending on services increased at a brisk annual rate of 7.9% in the last quarter.

For decades, Americans have not had to worry about inflation. As prices rise at a rate not seen since the 1990s, many people have yet to feel the effects of inflation on their wallets. So far, some people have been unable to reconcile the reality of price increases with the lifestyle changes required to adapt.

According to Wendy Edelberg, director of the Hamilton Project, an economic-policy initiative within the Brookings Institution, those who did not lose their jobs due to the pandemic were able to save significantly and are not making changes. Since their post-pandemic financial lives are secure, these groups may absorb rising prices more easily. In addition, during the pandemic, many people increased their savings and made progress toward their financial goals.

According to the Commerce Department, sales at US retail stores, online sellers, and restaurants increased by a seasonally adjusted 1.7% in October compared to the previous month. Thus, despite constant Covid-19 fears and inflation concerns, consumers continued to increase their spending.