Huobi is one of the most popular crypto exchanges and provides various features such as margin trading, staking, lending, etc. Furthermore, the platform also offers its in-house GRID trading bot. In this article, we’ll be going through all the aspects of the Huobit trading bot and also the steps of using free crypto trading bots.

Summary (TL;DR)

- Huobi is one of the most secure platforms with more than 200 cryptocurrencies.

- It has many products, including Grid trading bots, Futures trading, Margin trading, OTC, etc.

- Furthermore, you don’t have to pay any third-party for crypto trading bots.

- The in-house bots by Huobi are entirely free and you only have to pay a trading fee.

- Their trading fee is relatively standard. However, you can reduce it by HODLing HT tokens.

- The platform is suitable for both beginner and Advance level traders.

What is Huobi?

Huobi Global is a worldwide cryptocurrency exchange platform with its services being used in more than 130 countries. According to CoinMarketCap, the platform’s position under spot trading is second. Moreover, it offers different products, including GRID Trading Bot. To learn more, read our Huobi review.

What is Grid Trading?

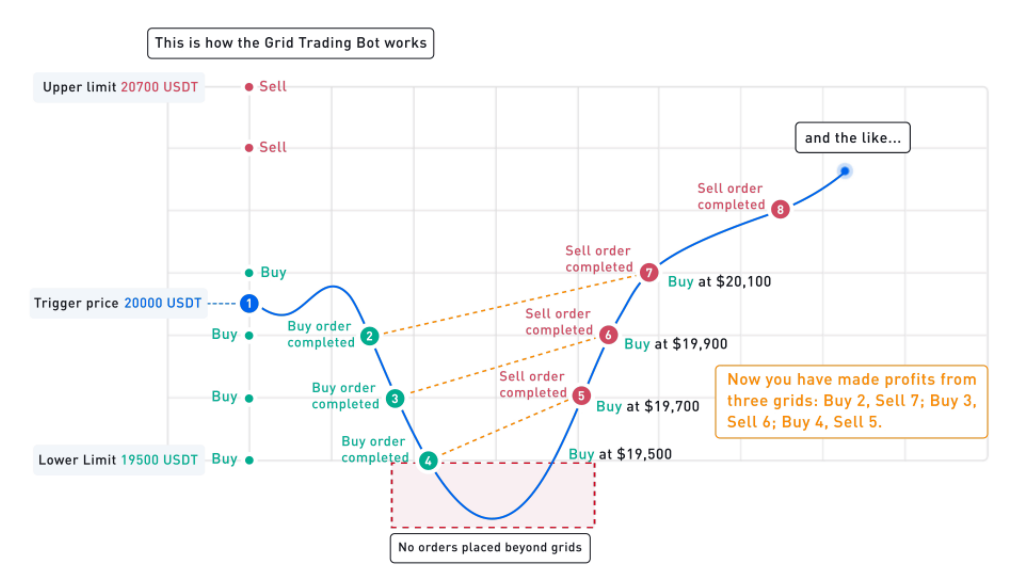

Grid Trading is one of the many trading strategies. It lets you buy low and sell high automatically in a specific price range. Moreover, Grid Trading robots will make sure to implement this strategy perfectly.

Also, as long as the crypto price does not break through the set range, the grid trading bot will continue to trade. However, if the price does break, grid trading will suspend. When the crypto returns to the range price, the bot will continue to operate.

To learn more, read 5 Best Crypto Grid Trading Bots.

Huobi Trading Bot: Modes

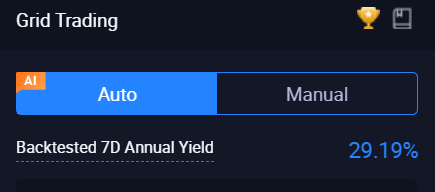

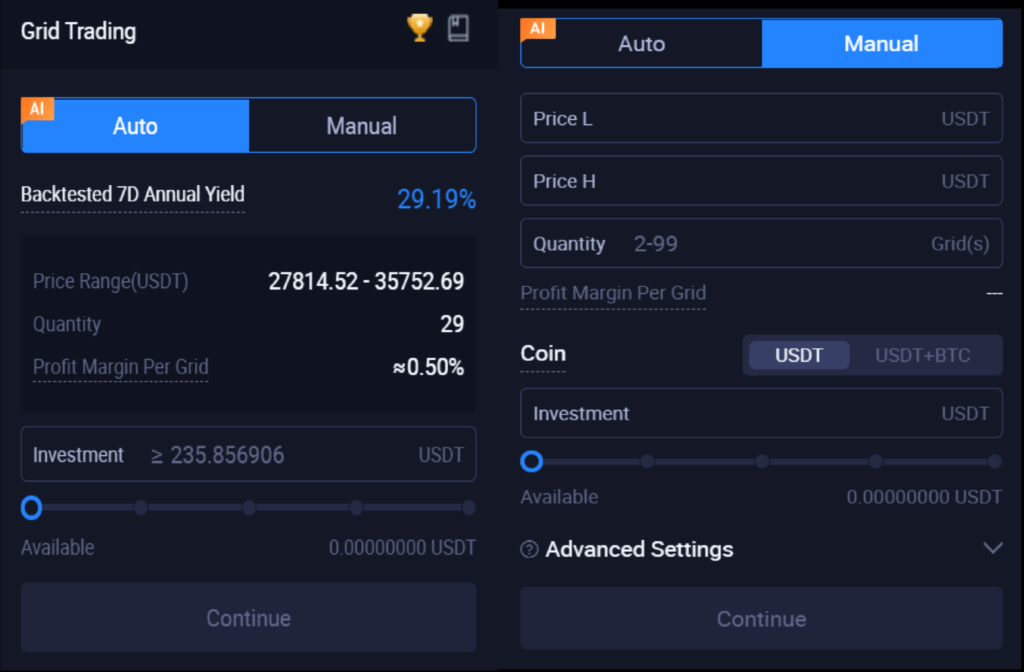

Huobi Grid Trading bot has two order opening modes: Manual and Auto.

- Manual Mode: Under this, you set the grid parameters, including upper/ lower limit, grid number, invested digital assets, and so on. In manual mode, you can also set the Stop loss and Trigger Price. This mode is preferred for advanced-level traders.

- AI Mode: As the name suggests, the system at Huobi sets the most appropriate parameters based on the historical data in Auto mode. Here, all you need to set is the investment price. However, you can’t fix the Stop Loss. Therefore, beginner traders with no or less knowledge should prefer it.

Huobi Trading Bot: Glossary

- The Lower Limit: It is the lowest price of the grid. If the market price crosses this limit, the bot will not place orders.

- The Upper Limit: It is the highest price of the grid. If the market price crosses this limit, the bot will not place orders.

- Grid Number: It is counted as by splitting the price range into multiple smaller fields.

- Take-Profit Price: When the crypto asset’s price rises to the Take Profit Price, the Huobi bot automatically closes the order so that it can take a return before the price comes down. This Take-Profit price should always be higher than the highest price.

- Stop-Loss Price: The stop-loss price setting must be less than the lowest price. Whenever the trading crypto price falls to the Stop Loss Price, the bot will start selling the bought assets at a loss to prevent higher losses.

- Profit Margin Per Grid: It is calculated based on the backtesting after a you set the parameters.

- Knowledge Test: Before you begin using the Huobi grid trading bot, you’ll have to pass the knowledge test.

Steps to use the Huobi Grid Trading Bot

Now, follow the below steps to set grid trading bot on Huobi:

- First, log in to your Huobi account.

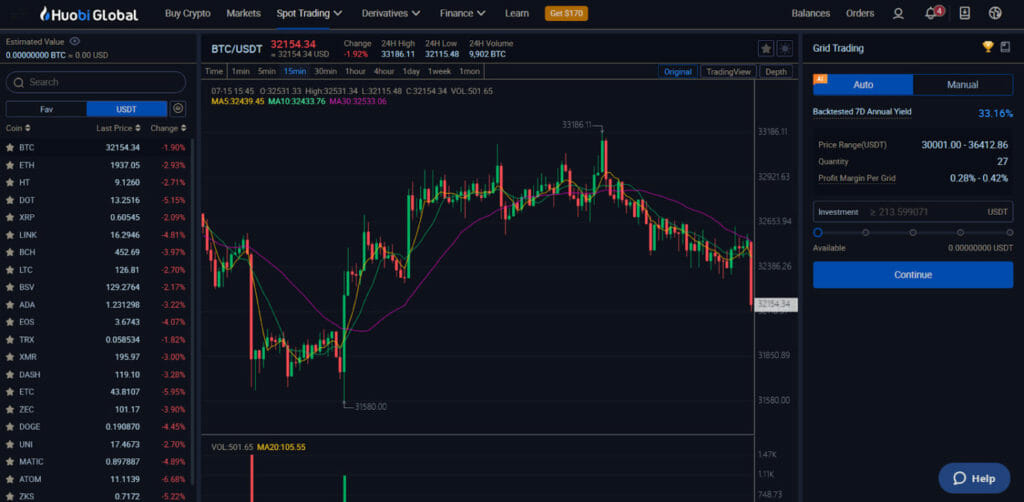

- On the top menu, click on “Spot Trading” and then “Trading bot.”

- Select “Trading bot” from the drop-down list.

- Select the pair you want to trade.

- In the Auto section on the right-hand side, enter the parameters.

- Huobi mentions the minimum investment amount in the investment textbox for that particular coin.

- Click on “Continue.”

- A dialog box will appear, read the details, including the strategy the bot will be using, and click on “Confirm.”

Please note that the auto-filled parameters are based on the 7-day backtest data of that particular pair.

Also, read Huobi Leverage Trading | A Complete Guide.

Huobi Trading Bot: Fees

The in-house crypto bot by Huobi is entirely free to use. However, you’ll still have to pay the trading fees. Furthermore, the maker and taker fee depends on your’s 30-day volume trading and HT token holdings.

Huobi Trading Bot: Withdrawal Limit

The withdrawal limit for verified users is 100 BTC and for unverified users is 1 BTC, respectively.

Supported Trading Pairs

Currently, Huobi Global has 32 trading pairs, including the top pairs like BTC/ USDT, ETH/ USDT, and HT/ USDT. In April 2021, Huobi added around ten trading pairs to Grid Trading, including MATIC/ USDT. Moreover, the maximum amount each trading pair a user can invest is 5,000,000 USDT.

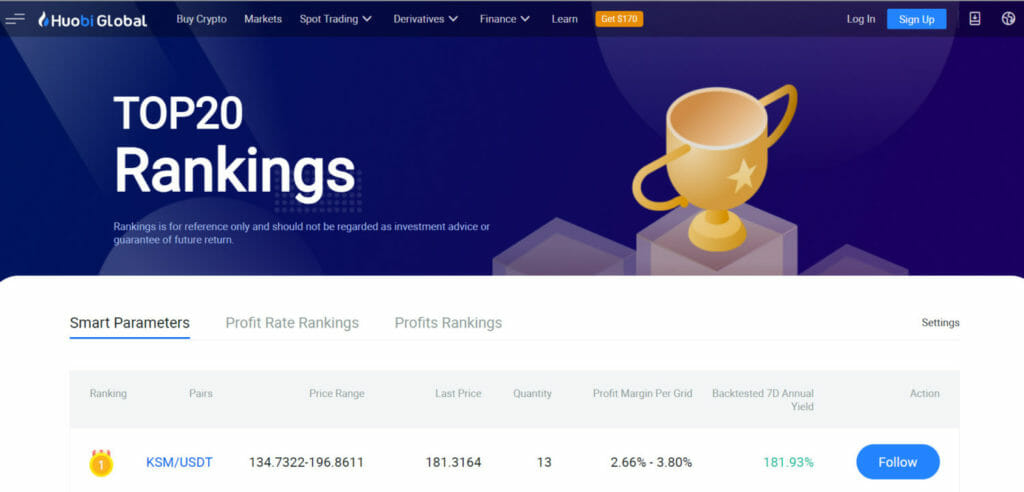

Huobi Trading Bot: Ranking Page

The platform also ranks the top 20 trading bot strategies on its ranking page. Furthermore, this ranking is available based on three different parameters namely, Smart parameters, Profit rate rankings, and profits rankings.

However, the platform suggests using these rankings only for reference purposes and not investment advice.

What are the risks of using Huobi trading bot?

- Scenario 1: If the prices of the trading pair fall below the range, the grid bot will stop placing orders and generate losses. Moreover, if you’ve set a stop-loss price and it gets triggered, the grid strategy will end.

- Scenario 2: If the price goes above the range, the grid bot will stop placing the order, and as soon as the price falls in the range, it will continue to place the trade. This way, you won’t be able to benefit from the rising price.

- Scenario 3: The grid strategy at Huobi places an order based on the price range and grid quantity. If the grid quantity is set extremely low and the price fluctuates between the two points, the system will not perform automatic order if the capital use efficiency is low.

Huobi Trading Bot: Pros and Cons

| Pros | Cons |

|---|---|

| Huobi offers 32 crypto pairs for grid trading bot. | Since the bot is in its initial stages, it does not offer variety. |

| No subscription fee is required for the trading bot. | |

| Furthermore, the platform has high security. | |

| 24/7 customer support. |

Huobi Trading Bot Alternatives

1. 3Commas

3Commas is a crypto trading bot provider that is simple and easy to use. The platform is dedicated and aims to reduce risks and maximize the profit of the traders.

3Commas has a system and algorithm that is transparent and straightforward. In addition, the platform offers various exciting features and ready-to-use strategies to its users. To know more read out 3Commas Review.

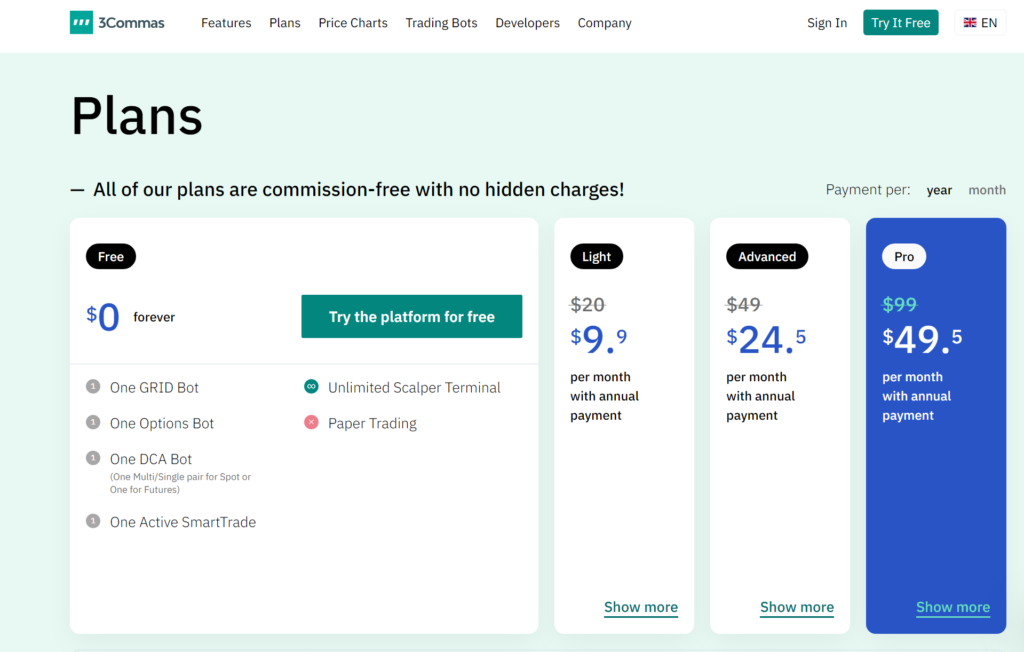

3Commas Pricing

Is 3Commas safe?

Yes, the platform is safe to use. The fact that it has so many features makes it convenient for all kinds of users to pick them. In addition, the platform offers detailed information regarding its refund policies.

2. Pionex

Pionex is a popular Cryptocurrency Exchange with inbuilt trading bots is that allows you to access 16 unique trading bots for no additional fee. Not only it supports manual trading using crypto-to-crypto conversions, but it also allows you to automate your investing strategy, therefore, eliminating the need for constantly monitoring the market. To know more, read our Pionex Review.

Pricing

- Currently, Pionex charges 0.05% out of the total trade value whether you are a market maker or a taker.

- Moreover, there is no minimum deposit requirement. However, a withdrawal fee is charged that varies by coin, alongside quantity limits. If you provided your KYC details, however, increase the withdrawal limits.

Security

- Pionex platform grants a safe environment for its traders as it is backed by Gaorong Capital, Shunwei Capital, and ZhenFund.

- Further, it has attained the U.S. FinCENs MSB (Money Services Business) License. Its the same license that Binance and other top exchanges have applied for.

Huobi Trading Bot: Conclusion

Huobi is one of the most popular crypto exchanges and it recently started offering its own trading bots. The Huobi Grid trading bot is simple to integrate and is made available for both beginner and advanced-level traders. Besides Grid Trading, it offers a brief FAQ support system to answer users’ queries.

Furthermore, the bot is entirely free to use and is running in its Beta version. Hence, we can expect many more features in the coming months.

Frequently Asked Questions

Is Huobi Safe?

Yes, Huobi is a safe platform and is trusted by millions of users across the world. According to them, the platform keeps security their highest priority and invest in the same. To keep user’s accounts safe, they also support two-factor authentication, SMS, and email notifications.

How to set up a Grid Trading bot in the Huobi app?

In the Huobi Global app, follow the following steps:

– First, log in to your Huobi app and locate “Grid Boat,” and click on it.

– Select the trading pair from the top menu where the default pair has been selected.

– Select how you want to create the strategy: Auto or Manual.

– Enter the parameters and click on continue.

– Review the points and click on “Confirm.”

Why is Huobi still allowed in China?

Huobi Global has banned the China residents from accessing its derivatives. However, they can still create their account and trade using spot trading.