Born in the wake of the last financial crisis almost a decade ago, Bitcoin, marked the beginning of a new financial era.

In about a decade, Bitcoin has made a presence in the global economy as an asset class of itself and giving birth to a whole new decentralized finance space.

Poised to fix the many fundamental issues that currently cripples the fiat currency, bitcoin, possess some key characteristics that make for “good” money. The biggest one is that it cannot be controlled or manipulated by any authority.

So, the question that arises now is that if Bitcoin is so great, why haven’t we seen mass adoption yet? The biggest barrier to mainstream adoption for bitcoin and other cryptocurrencies is its price volatility.

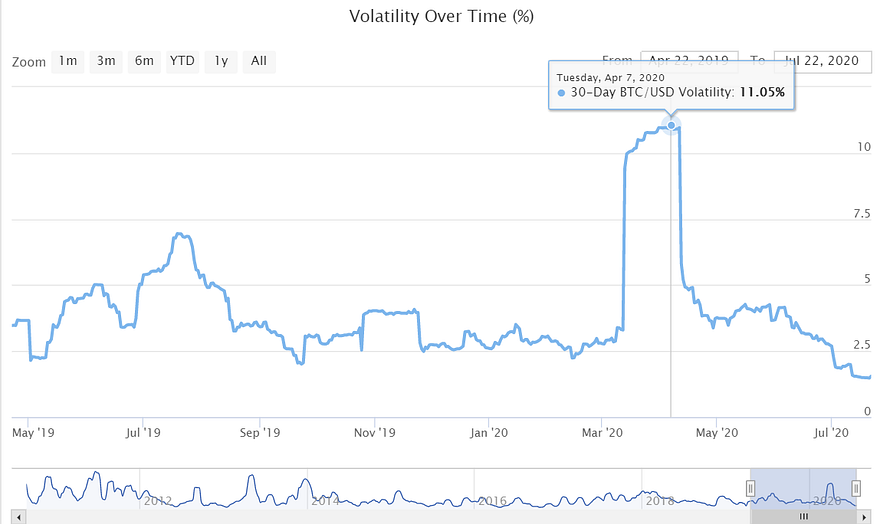

Bitcoin’s 30-day BTC/USD price volatility as of July 29, 2020, is at 2.26%, which, interestingly for bitcoin, is not on the higher side. Between March and April 2020, BTC volatility reached as high as 11%.

When we compare this figure to traditional price standards such as gold and fiat (USD), we see that the volatility for fiat averages between 0.5% –1% while for gold, it’s at around 1.2%.

So what makes Bitcoin so volatile?

Table of Contents

Bitcoin is a New Technology

With only a decade old, bitcoin is still in a nascent stage. Think of it as the Internet back in the ’90s. Bitcoin as a technology is still being understood by people and new developments happening every day.

Technological challenges such as bitcoin’s scalability issues, which often lead to high transaction prices and occasional network congestions, cause a downward trend in bitcoin’s price.

While advancements in bitcoin technology such as Lightning Network cause an upward trend in the price, the current market cap of Bitcoin sits at $172 Billion, which is the highest for any cryptocurrency still is minuscule compared to gold whose market cap is around $10.9 trillion.

A movement of say $500 million would not even be noticed in the gold market, while in the Bitcoin market, such a movement can cause a significant change in its price.

Also Read: Bitcoin Vs Gold – A better Store of Value

Regulations and Media

Bitcoin is mostly unregulated globally, with each country having its laws regarding bitcoin and cryptocurrency.

With every new development in the regulations of cryptocurrency, bitcoin users’ usage behavior changes, adjusting to the new environment.

Plus, the media plays a significant impact on bitcoin prices. Research published by ScienceDirect analyzed the relation of Bitcoin price and media attention. They quote:

“The empirical results indicate that Bitcoin prices are partially driven by momentum on media attention in social networks, justifying a sentimental appetite for information demand.”

Speculation

Bitcoin is a highly speculative market that contributes heavily to its volatility. Investors/Traders speculate on a bitcoin price to go up or down and buy and sell accordingly.

Added to this is the ease with which one can start trading cryptocurrency, the only requirement is an internet connection.

It is estimated that there are about 53 million bitcoin traders currently around the globe.

This leads to many amateur traders entering the trading market, making the market highly vulnerable to the hype, FOMO(Fear of missing out), FUD (Fear, Uncertainty, Doubt) causing panic buying/selling.

Bitcoin and E-commerce Merchants

It is no doubt that this volatility poses a significant roadblock for bitcoin’s adoption by merchants. So, if bitcoin is so unstable, why should merchants even bother to accept it in the first place?

Bitcoin Market is Hugeee….

The number of people using bitcoin has seen a sharp rise in the past few years. It is estimated there are around 100 million bitcoin users worldwide, performing about 377,323 transactions per day.

The number of offline venues that accept bitcoin has reached 19,505 as of July 2020.

A survey conducted in 2019 called bitcoin, a demographic mega-trend. With 18% of 18–34 years old already owning bitcoin. They mention:

“Younger demographics lead in terms of Bitcoin awareness, familiarity, perception, conviction, the propensity to purchase, and ownership rates.”

Bitcoin’s popularity is only increasing, and people are opening up to the alternate way of financing free from censorship, control, and manipulation.

For merchants, accepting bitcoin can be extremely lucrative as it will open doors to a whole new array of users.

Thankfully, there are ways for merchants to protect them from the price volatility and still accept bitcoin.

StableCoin

Stablecoin, like Bitcoin, is a type of Cryptocurrency with one distinct feature; its price is Stable.

Stablecoin’s primary value proposition is its protection against volatility, so they serve as a gateway between fiat and cryptocurrency.

There are several Stablecoins currently in the market.

1. USDT (Tether): This is currently the most popular Stablecoin available in the market with a $10 Billion market cap.

Tether is fiat collateralized at a 1:1 ratio. Therefore, every USDT coin is backed by 1 USD.

2. USDCoin (USDC): This is another popular stable coin created by Coinbase, a major cryptocurrency exchange platform.

Similar to Tether, USDC is Fiat collateralized at a 1:1 ratio against the US dollar. Its market cap currently stands at $1.1 Billion.

Some other popular stable coins include TrueUSD (TUSD), PAX, DAI, Binance USD (BUSD)

Fiat

Another option to protect your payments from volatility is converting your payments into a fiat currency of your choice.

The most popular fiat currencies for conversion include USD, Euro, CAD, AUD. This conversion can happen in real-time, meaning you are 100% protected against any price volatility.

How to Convert to Fiat or StableCoin?

Several crypto payment processors offer the feature to auto-convert crypto payments into your desired coin.

1. CoinPayments: A popular crypto payment processor supports a host of coins and packs bitcoin conversion features such as:

- Auto-Sweep: Converts your entire balance into the desired coin of your choice every night. ShapeShift, Changelly, or Kyber support conversion.

- Auto-Convert: Converts payments into your desired coin in real-time.

- Fiat Conversion: Converts received coins into the fiat currency of your choice in real-time. CoinPayments support fiat conversion via CoinMotion and Wyre integration.

2. Blockonomics: A decentralized bitcoin payment processor allows for Fiat and Stablecoin conversion.

The conversion feature is available via integration with Uphold.

3. MyCryptoCheckout: This crypto payment processor is available as a WordPress plugin and is fully decentralized.

The plugin features AutoSettlements, which connect your account to crypto exchange (Binance or Bittrex), where you can automatically convert your bitcoin into either fiat or stablecoin of your choice.

4. OpenNode: A popular Bitcoin Payment processor that supports both on-chain & Lightning Network payments with many features that make accepting Bitcoin payments simple:

- Automatic Conversions from BTC to Fiat and vice versa with Fiat to BTC

- Ecommerce Integrations with Shopify, WooCommerce, and many others

Also Read: Best Bitcoin Payment Processors

Conclusion

Bitcoin is often compared to the internet revolution of the ’90s, something that will reshape the current financial system for the better.

But, despite the cutting edge technology, it does possess challenges that obstruct its mainstream adoption.

It is easy for merchants to shy away from bitcoin due to its price volatility and only accepts fiat, but in doing so, they also give up one of the biggest growing markets.

Thankfully, there are ways for merchants to accept bitcoin and protect themselves from the price fluctuations.

By integrating their payment processor with Stablecoin and Fiat conversion, merchants can reap the benefits of the crypto market and protect their earnings.

Stablecoin allows them to hold their assets in cryptocurrency at a stable price. At the same time, fiat provides the traditional price stability benefits of a currency that most merchants already use.

Attribution

This article contributed by Arpit from the Blockonomics Team.

Also Read

- Stablecoins – A simple overview

- Convert Bitcoin – Best Crypto Exchange Services

- The Ultimate Guide to DeFi (Decentralized Finance)

- Blockonomics Review – Accept and Track Bitcoin Payments

- NOWPayments Review: A Non-custodial Crypto Payment Gateway

- OpenNode Review – A Bitcoin-only Payment Service

- Best Bitcoin Payment Processors