Like futures contracts in stock or commodities, you can also trade the futures for some crypto assets. This is a relatively new addition to investing and trading in cryptocurrencies, as futures trading was introduced in 2017 for crypto assets. However, there are nearly 6000 cryptocurrencies in the market, and trading their futures contract would give rise to many new opportunities for crypto enthusiasts.

Sometimes people do get confused and assume that futures trading means options. But they are two different methods of derivative trading. So let us understand what futures trading in cryptos is.

Table of contents

- Summary (TL;DR)

- What are Futures?

- What is Crypto Futures Trading?

- How does Crypto Futures Trading work?

- Futures Trading: Glossary

- Best Crypto Futures Trading Exchanges

- Things to know before entering Crypto Futures Trading

- Steps to begin trading in Crypto Futures

- Futures Trading: Pros and Cons

- Futures Trading: Conclusion

- Frequently Asked Questions

Summary (TL;DR)

- Cryptocurrency futures trading lets you buy or trade crypto without actually owning one.

- Futures trading can be done to speculate the direction of the underlying asset.

- It is an excellent tool for hedging as well, especially for investors in spot crypto.

- Many exchanges give you the option to select the time for the futures contract.

- You can trade with leverage and initial margin without investing in the total contract value.

- Learn about perpetual contracts, mark price, funding rate, PnL, and more further in the article.

What are Futures?

Futures trading is an agreement between buyer and seller to transact at a predetermined price and time in the future. The underlying asset can be anything like stock, commodity, or cryptos. Furthermore, it is an obligation between the parties to transact at a predetermined future date and price.

What is a Futures Contract?

The futures contract is a derivative financial contract between two parties. With a futures contract, the investor is speculating the direction of the price movements of underlying assets.

Futures Contracts

| Currency pairs | BTC USD | ETH USD | LTC USD | BCH USD | XRP USD | BTC EUR | ETH EUR |

|---|---|---|---|---|---|---|---|

| Timeframe | Perpetual Monthly Quarterly Semi-annual | Perpetual Monthly Quarterly Semi-annual | Perpetual Monthly Quarterly | Perpetual Monthly Quarterly | Perpetual Monthly Quarterly | Perpetual Monthly Quarterly | Perpetual Monthly Quarterly |

| Contract/ unit size | 1 USD | 1 USD | 1 USD | 1 USD | 1 USD | 0.001 BTC | 0.01 ETH |

| Collateral | BTC | ETH | LTC | BCH | XRP | EUR | EUR |

| Type | Inverse | Inverse | Inverse | Inverse | Inverse | Vanilla | Vanilla |

What is Crypto Futures Trading?

Crypto futures allow you to gain exposure to a digital currency without actually possessing it. The contract for the crypto futures derives its value from their underlying digital asset like Bitcoin or Ethereum. Furthermore, these contracts have a set expiration date and set price, which is known upfront.

Futures are recognized by their expiration date. When the contract nears expiry or is on the expiry date, the trader will use cash to close the contract. Moreover, they are used as a hedge against adverse price movements and extreme volatility of crypto assets. Since high volatility and quick price movements will help the trader to buy the futures contract when the price is low and sell when it goes high or vice versa.

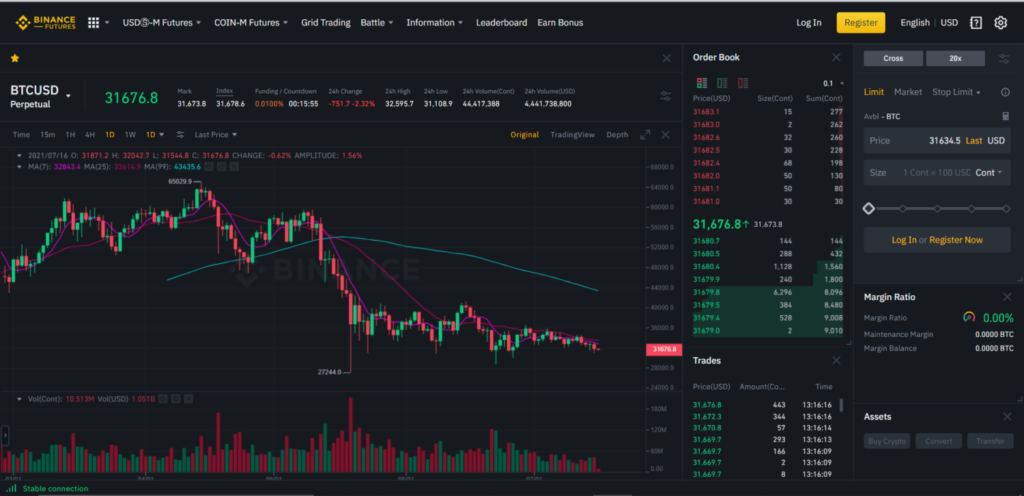

Crypto futures trading platforms like Binance, Kraken, FTX, etc. and allow you to buy or sell a futures contract 24×7.

The traders need to exercise extreme caution and prudence while trading in crypto futures too. Therefore, it is good to learn the basics before trading/ investing in these derivative contracts.

How does Crypto Futures Trading work?

Not all asset classes are suitable for all types of traders or investors. For example, there is a lot of negativity surrounding the new digital asset class like cryptos due to the high volatility. But some traders can use this volatility to their advantage and make some incredible profits out of it.

The most important thing about futures trading is that you do not need to hold the actual cryptocurrency and risk its price movements via a futures contract.

Let us take an example to understand this better.

- A and B are two traders who have a position in the Bitcoin futures contract at $40,000 each.

- A has a long position, which means he expects the underlying asset Bitcoin to go up.

- B has a short position, which means she expects the underlying asset Bitcoin to go down.

- At expiry, the price for Bitcoin futures is settled at $45,000 for each contract. Therefore in this scenario, B is holding a losing position will have to pay $5,000 from her capital.

- A has made a profit of $5000 from the exchange.

Futures Trading: Glossary

We will now discuss some basic concepts of crypto futures trading that will help you in becoming a professional trader.

Perpetual Contract

This is a particular type of futures contract which doesn’t have an expiry date. Most future contracts will have an expiry date, but a perpetual contract will continue until perpetuity, as the name suggests. This means a trader can hold a position for as long as one wants. The trading of a perpetual contract is based on an underlying Index Price. The Index Price is made up of the average price of an asset, as per the significant spot markets and their relative trading volumes.

This makes the perpetual contract trade at a price equal to or very close to the spot markets. However, during a highly volatile session or any such market conditions, the market price may deviate from the spot price. The most significant difference between a perpetual contract and a regular contract is the lack of expiry date.

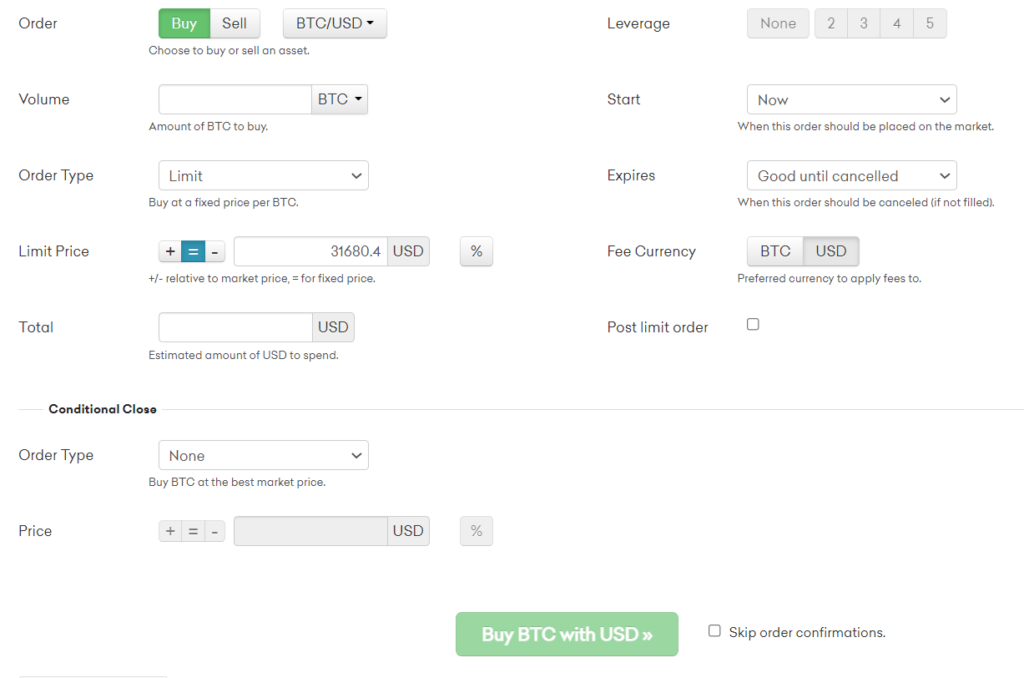

Leverage

With leverage, the trader doesn’t need to put up 100% of the contract value to trade in the futures. Instead, the broker or the exchange will require only an initial margin amount for you to start trading, which will be a fraction of the total contract value.

To buy one Bitcoin on the spot market, you may require $33,523 per bitcoin as per the current market price. With a futures contract, you can open a position in the futures market of Bitcoin at a fraction of its spot price. This is possible only with leverage or margin. The more leverage you have, the less money you need to take a position.

Also Read: An Ultimate Guide To Leveraged Token

Margin Requirements

An initial margin is required to take a future position. Initial margin is a percentage of the total futures contract value paid in cash or collateral when using a futures trading account. After taking the position, the trader has to pay a maintenance margin which is the minimum amount that traders need to keep the position open.

Maintenance margin checks are continuous and help in margin utilization calculation. If the trader’s Maintenance margin limit is hit, the exchange will liquidate your position.

Hedging and Stabilization

The futures trading in cryptos can help in hedging an open position in the spot markets. Say the trader is long in the spot and wants to mitigate his risk. He can go short in the futures markets to cover any untoward losses and have what will continue until getting an earning opportunity. Speculation plays a critical role in bringing—,stability in the long term.

Also Read: Spot – Futures Crypto Arbitrage Trading Bot

Liquidation

When the loss falls below the maintenance margin the crypto exchange automatically sells your collateral to prevent its losses. This selling of your collateral by the exchange is called liquidation.

There may be an additional fee applicable on an account that goes through the liquidation process. It is advisable to either close your position or add additional funds to avoid this.

PnL (Profit and Loss)

Profit and loss can be realized or unrealized. When a trader has an open position of a perpetual futures contract, you have an unrealized PnL, which means it keeps changing as per the market moves. When you close your position, the unrealized PnL becomes realized, which could be partly or entirely. The realized PnL comes from the closed position and has no connection to the market price but only its closed-off price. The Mark price is used to calculate the unrealized PnL and this constant fluctuation is the primary driver of liquidations.

Also, read: Rebalancing Strategy For Your Crypto Portfolio

Funding rate

Funding is the regular payment between buyers and sellers. When the funding rate is above zero (positive), traders having long positions will pay to the ones that have short positions and vice versa The funding rate depends on the interest rate and premium. Most exchanges fix the interest rate. However, the premium keeps fluctuating following the price difference between the future and spot markets. The crypto exchanges don’t charge anything additional on the funding rate, as it is a direct exchange between users.

When a perpetual futures contract is trading at a premium (higher than the spot market), the long position will pay the short since it will be a positive funding rate. This will lead to pulling the price of the perpetual contract down as longs will close, and there will be more open short positions.

Mark Price

Mark price estimates the actual value of a contract (fair price) compared to its actual trading price (last price). Thus, the calculation for mark price prevents unfair liquidations when the markets are highly volatile.

Insurance Funds

The Insurance Fund is collected to prevent the balance of losing traders from dropping below zero and also ensures that winning traders get their profits. The insurance fund comes into action when the system cannot close a position on time, and the market drops steeply. The Insurance fund is designed to use collateral taken from liquidated traders to cover the losses of bankrupt accounts. In normal market conditions, the Insurance Fund is expected to grow continually as users are liquidated.

Auto-deleveraging

It refers to a method of counterparty liquidation that only takes place if the Insurance Fund stops functioning during a particular situation. This is a doubtful situation, in which the traders with profits will contribute to cover the losses of the losing traders. Unfortunately, the cryptocurrency markets are highly volatile. They have high leverage offering to the clients, and it won’t be possible to avoid this situation entirely.

In this situation, a counterparty liquidation is a final step to be taken when the Insurance Fund cannot cover all bankrupt positions. The positions with the highest profits and leverage will contribute more. The exchanges and systems handle all the possible precautions to avoid auto-deleveraging and follow several steps to minimize its impact.

Best Crypto Futures Trading Exchanges

| Exchange | Features |

|---|---|

| Binance | – Automated recurring buys – Over-the-counter trading – Staking rewards |

| Kraken | – Nearly 60 cryptocurrencies – Margin and futures trading – OTC trading – Multiple trading platforms – Educational resources – Staking rewards |

| FTX | – Trade all DeFi tokens – Low fees and easy to use platform – Clean mobile app for iOS and Android |

Things to know before entering Crypto Futures Trading

Futures is a contract that is settled financially in cash, and there are no exchanges on any cryptocurrency. Furthermore, a trader merely speculates on the price of the crypto without buying the underlying asset. Thus, no cryptocurrency trading platform or wallet is needed. The futures contracts are settled financially on the delivery date or offset by traders by reversing their positions as the delivery date approaches.

When the buyer or seller of the futures contract sees a profit on or before the delivery date and wishes to liquidate the position, then the difference between the purchase price and settlement price is paid out to the trader holding the futures contract.

Steps to begin trading in Crypto Futures

Learn how Crypto Futures Trading work

- You must learn the initial and maintenance margin requirement for various cryptos. It will be different for each one of them. E.g., Bitcoin futures have very high margin requirements.

- Also, keep in mind how closely the futures price tracks the spot price, the liquidity in the market, and how the other traders and market makers are positioned.

Make a trading plan

- Having a trading strategy and implementing the same is probably the most crucial step in crypto futures trading. First, carefully analyze the market, the crypto, and the type of contract you wish to trade-in. Then, study multiple cryptos, their futures movement, margin requirements, and the market movement individually and overall before making any move.

- Learning the technical and fundamental analysis indicators for the underlying cryptos and futures will help you get signals for buying and selling the contracts.

- A futures trader has to be a strict money manager. Position sizing must always be on track for a volatile market like crypto futures.

Also, read Simple Steps to Test your Trading Strategy

Test your system

- Often a broker you select will provide you with a virtual or a demo account where you can test your theories and trading plan and get a feel of it. In addition, it is an excellent confidence-building exercise, as the trading simulator will allow you to practice your plans without actually using any funds.

- Once you can develop enough confidence, you can start with funding your trading account. Always start small to save money and avoid unnecessary stress. Then, as you build your confidence with each trade, you can increase your positions.

- A broker’s account can help you by judging its various facilities and systems. You can start a demo account with more than one broker and then select the one which is best suited to your style.

Futures Trading: Go Live

Now is the time to take all your learning live and start trading in crypto futures. Remember that putting real money can have a different effect on your trading behavior, so you make sure you consider that while trading. Always arrange for an emergency fund, just in case you require to fund your existing position to prevent liquidations. Finally, always use a stop-loss.

Also, read 3 Best Futures Trading Bots | Future Bot

Futures Trading: Pros and Cons

| Pros | Cons |

|---|---|

| Future trading is used as a speculation tool to predict the direction of the price of the asset. E.g., You can permanently short sell or buy a future contract of any cryptocurrency if you’re expecting changes in its price. | There is always the risk of losing more than their initial margin since futures are traded on leverage. |

| It works as an excellent hedging tool for traders and investors. E.g., If you feel Bitcoin may fall from the current levels, you are long in the spot markets. Therefore, you can short sell a futures contract of bitcoin to hedge your position, meaning to safeguard your spot position against the fall. | Sometimes hedging may work against you, and the trader may lose out on a favorable price movement. |

| Future contracts are traded at a fraction of their total value. | Margin trading is always a risky proposition, as when you make money, it is amplified, so are losses. |

Futures Trading: Conclusion

Crypto Futures Trading is the new frontier in the digital asset class; when used wisely can be an excellent hedging and speculation tool for a trader and investment. Futures trading is an extremely capital efficient trading method when used prudently, could give excellent results. By keeping low collateral, crypto futures allows the trader to take a high leverage position. This gives him the flexibility to take positions in the markets and maintain a low exchange risk.

Frequently Asked Questions

Can I invest in the futures for all crypto assets?

Not all cryptos are traded in the futures market. But the bigger ones and the popular ones are so you can start with them.

Do I need to open a separate account for futures trading?

No, while trading on platforms like Binance, you only need to create and verify your account on Binance. Thereafter you’re eligible to use all the products of the platform. However, you’ll still have to activate your futures account in Binance, and deposit funds to your futures account from your Fiat or Spot account.

What is a perpetual contract?

This is a particular type of futures contract which doesn’t have an expiry date. Most future contracts will have an expiry date, but a perpetual contract will continue until perpetuity, as the name suggests.