There is a new trend in DeFi town, some are calling it “Yield Farming” and others are “Liquidity Mining”. Those who hold cryptocurrencies are now going to back to farming.

What is Yield Farming?

When you use your assets to provide liquidity to a protocol to earn interest/fee or additional assets, that’s yield farming. It is also called liquidity mining.

Yield Farming incentvize users in order to provide liquidity to the protocols

Table of contents

How does Yield Farming work?

Let’s say there is a protocol, which helps users to exchange different cryptocurrencies. However, to enable trades, the protocol will require liquidity. If there are no assets, how people going to trade tokens.

But how to get his liquidity? In the traditional market, you pay a fee to hedge funds and other market makers to get this liquidity. But in DeFi, you can democratize this system by offering anyone to provide liquidity to the protocol in return of a value token and/or interest and/or fee.

DeFi Yield farming produce value for anyone willing to provide liquidity.

As mentioned, liquidity mining or Yield farming is an old technique to achieve liquidity in traditional markets. In crypto, Hummingbot provides rewards for providing liquidity on exchanges. However, in DeFi, this trend started catching on in 2020.

Let’s see some example of Protocol’s enabling yield farming.

Compound Yield Farming (COMP mining)

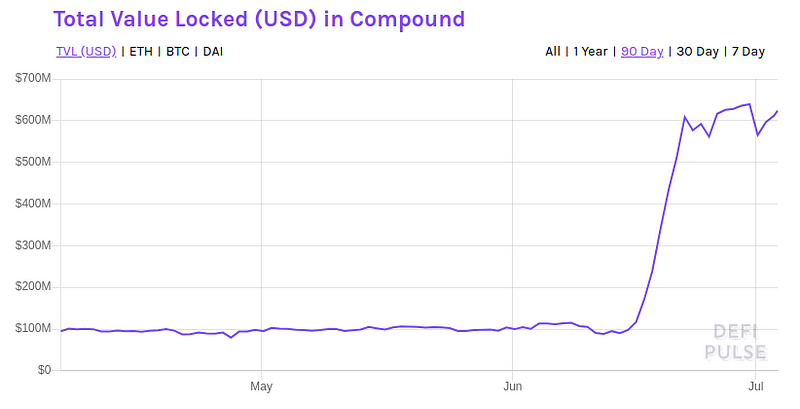

In June 2020, the Compound protocol launched a yield farming program. Compound is an automated Money Market protocol, using which you can lend or borrow digital assets. Till now, the Compound protocol was mainly governed by the Compound Team. But to enable decentralization, Compound launched a COMP governance token, which will be used to govern the protocol.

However, the question was how to distribute COMP token? For this Compound team launched a liquidity mining program in which anyone who will use the Compound protocol to lend or borrow, they will get COMP token on a pro-rata basis. A total of 2880 COMP will be distributed every day.

This way, everyone has a chance to earn COMP token by providing liquidity to the protocol. It also makes COMP valuable because when you lock your assets in the protocol, you have skin in the game; hence protocol governance becomes essential for you.

Synthetix Liquidity Mining (SNX)

Synthetix is an O.G. when it comes to DeFi yield farming. In 2019, Synthetix started a liquidity mining program in which you can earn SNX tokens by locking up your assets in Snythetix protocol.

You lock your assets and mint sUSD (Synthetix USD). Then you can use sUSD to buy other synths (Synthetix assets).

To enable this functionality, Synthetix protocol needed the liquidity which the team got by incentivizing liquidity providers with SNX token.

You might also be interested in:

Curve Yield Farming (CRV)

The Curve is another project that is a money market protocol for stablecoins. Using Curve, users can get the best exchange rates and exchange their stablecoin in a decentralized manner. Check out the following video to learn how Curve’s liquidity mining program works.

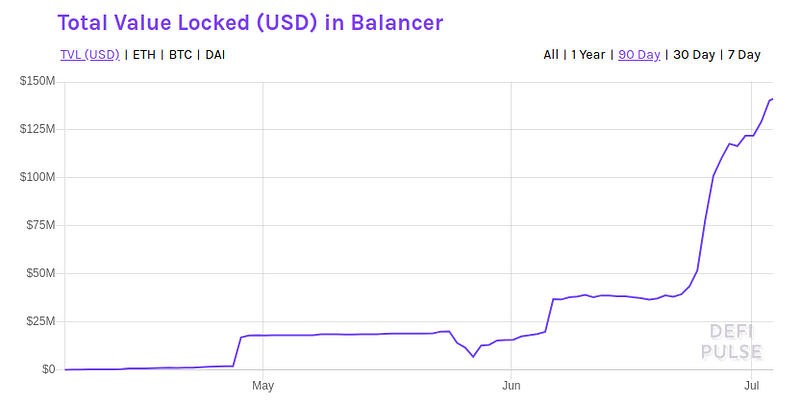

Balancer Liquidity Mining (BAL)

Balancer is another protocol where anyone can create liquidity pools in order to provide the best exchange rate for different assets. These pools contain different types of digital assets. However, to enable this the protocol needs liquidity, therefore Balancer now incentivizes liquidity providers with BAL tokens.

DeFi Yield Farming Risk

Yield Farming looks very attractive because some of these protocols provide more than 50% returns annually. However, there are many risks involved in yield farming.

Smart-contract bug

DeFi protocols are implemented using smart contracts, and these smart contracts are openly accessible by everyone. Therefore, there is always a risk of bugs surfacing and smart contracts get exploited in order to steal funds.

For example, recently a hacker exploited Balancer protocol and stole $500K worth of tokens. It was a bug in the handling of deflationary tokens by the balancer protocol’s smart contracts. You can read more about it here.

Most of these protocols go through proper smart contract audits. However, security audits don’t eliminate risks completely. Therefore, always aware of the risk and to protect yourself in these scenarios, use solutions like Nexus mutual.

Stablecoin Peg Fail

Almost, all the DeFi protocols use stablecoins. Some protocols, for example, Curve, solely depend on stablecoins. However, there is always a risk of these pegs failing for different reasons. For example, the MakerDAO team analyzed the risk of failing DAI peg because of the Compound protocol’s governance change.

In addition, these protocols use Tether stablecoin, which does not have a credible Dollar-peg history.

Admin Keys

Admin keys control different aspects of smart contracts. For example, admin keys can pause a smart contract, change different parameters, lock user’s funds, upgrade smart contracts, etc.

Developers of the DeFi protocol control these keys. Therefore there is always a risk of centralized take over of the protocol. To eliminate this risk, overtime protocols are moving towards DAOs (Decentralized autonomous organizations).

Liquidity crunch

When a significant amount of particular asset is locked in the different protocols to earn yield. It can create a liquidity crunch in the market, making the asset highly volatile. This can directly affect the asset price and yield mechanism of different protocols.

Leverage Yield Farming

Innovations like DeFi flash loans now enabled leveraged yield farming. For example, using InstaDapp, you can “Maximize $COMP mining” with a few clicks. You can leverage your asset 4 times, but it involves a great risk of liquidation. In addition, price volatility also liquidates your assets locked in a protocol. checkout the following video to learn how to maximize $COMP mining using InstaDapp.

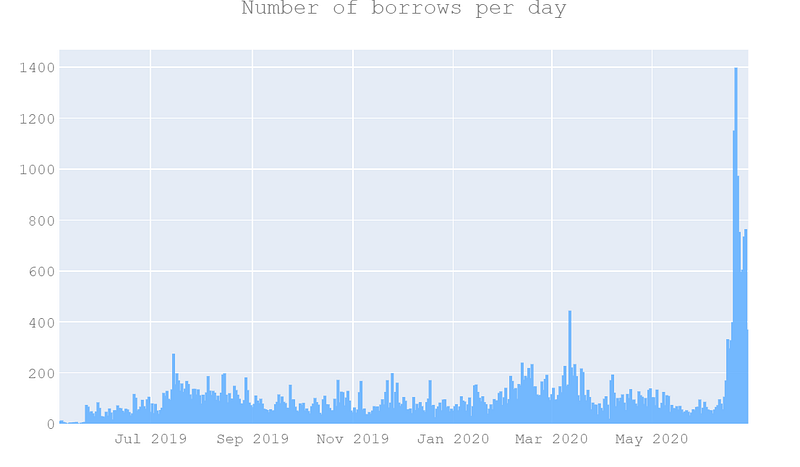

User Behavior change

In addition, there is a great risk of user behavior change when protocols heavily incentivize users for exploiting the protocol functionality. For example, In the case of COMP, users now incentivize to lend or borrow from the protocol, not because they need it; instead, they want to earn more $COMP. These explorations would lead to frequent changes in the procotol without analyzing them properly.

The following chart shows the number of loans increased/day because of the Compound liquidity mining program.

Yield Farming Tools

Although every protocol provides an interface to liquidity mining, there are third-party applications like Zerion and InstaDapp which enables extra functionalities. For example, InstaDapp released a simple tool to leverage mining using flash loans and compound. Using this tool you can “Maximize Compound mining” by leveraging your assets 4x times.

Conclusion

DeFi is democratizing Yield Farming. Anyone can put their asset to work and get a yield which traditional market can’t provide. However, there is greater risk involved here and you can’t recover funds if they are lost. So be cautious and only see these protocols as experiments.

You might also be interested in: