I lost everything that I invested in crypto. Yes, you read it right, I lost everything I invested in crypto, at least for the first few months. Every time I invested a certain amount, within a week I was REKT. The fun part is, I never understood where my money was going, and it took me 4 months to understand the basics of investing in crypto or to be honest, just getting used to the interface of exchanges.

Table of Contents

Where did it all begin?

Until the fall of 2020, I only had a fair idea about what crypto assets are, and it was in the January of 2021, I read a blog about crypto. The blog spoke about a guy turning his investments 1000x.

Doesn’t it sound awesome when you read about a guy turning $100 into $100,000? It does right! To be honest somewhat lucrative, as who wouldn’t risk a $100 for $100,000. And this is when I decided to take a fair share of profit from the crypto market.

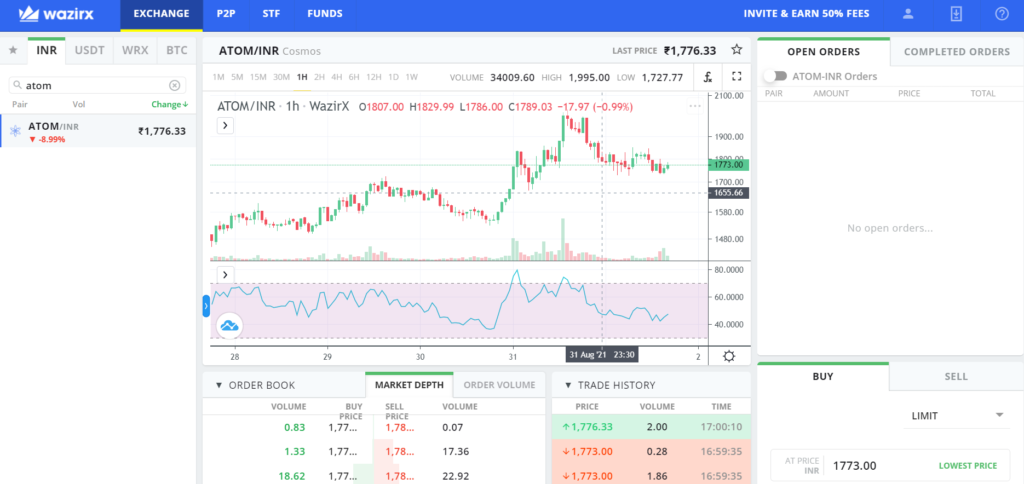

So this is when I downloaded WazirX, my first crypto trading app and also one of the best exchanges in India. I deposited $10 (which is around INR 800, but you can also start trading in India with just INR 100 [tbh, that’s the cost of a regular Margherita Pizza from Domino’s, haha…]) and bought ATOM.

Yeah, I know; I didn’t know a thing about ATOM’s fundamentals and what it does. Moreover, the only thing I knew about the coin was that its name sounded cool.

My first Trade as CRYPTO INVESTOR

I completed my first few trades and ended up losing almost 70% of my investment. Unfortunately, fear and greed play an essential part in a beginner’s trading journey, and the same happened to me.

I deposited another $100, and I bought a few more random assets (and this time mostly those whose name sounded technical to me). This time, I did make a profit of $10, not much, yes, but it was enough to fuel my overconfidence.

Looking back I realise I wasn’t even investing, it was just a craving to get rich overnight. Calling oneself a crypto investor doesn’t really make someone an investor. There is a considerable difference between Speculators and Investors. Moreover, investors usually win in the long run, and as it’s said

“You should only own such an asset, such that you’d be happy to own it, and have no worries if there is no way to check its price daily.”

Benjamin Graham

My take on Margin trading

Once I made a profit of $10, I started thinking of myself as a pro-investor. This is where my interest in margin trading got its roots from. I wanted to be rich overnight, and margin trading seemed to be the ultimate path to the goal.

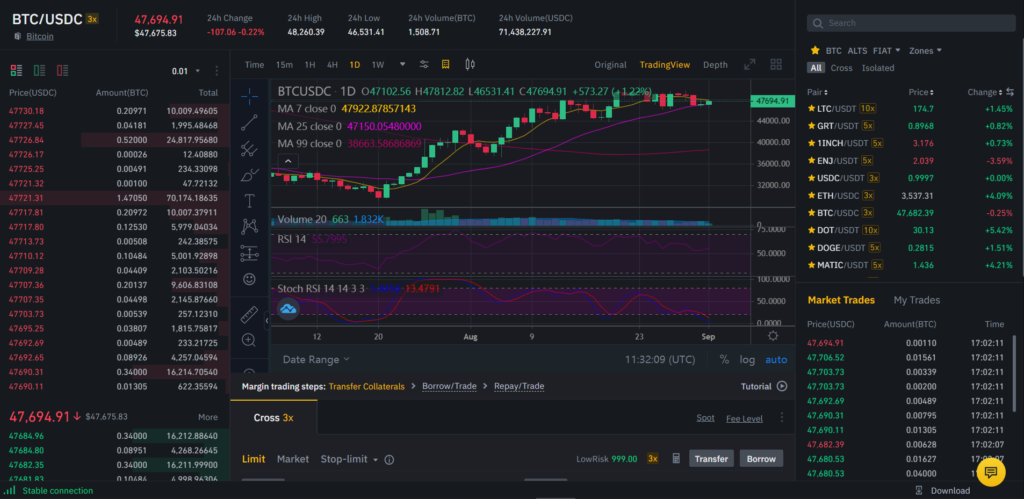

I watched a few youtube videos, read a couple of blogs, tried the demo mode at some of the platforms, and ended up creating an account on BYDFI. Talking about BYDFI, it offers a leverage of up to 100x on bitcoin, which is pretty lucrative, but enough to get you REKT in a few trades.

Thereafter, I deposited around $20 in my BYDFI account and opened a position of $5 with 50x leverage. Yes, I know, a damn fool! However, I got lucky and took a return of around $3 on this trade, further fueling my overconfidence.

After the first win, there followed a series of losses and small victories. Moreover, by the time I was revenge trading, I got REKT and deposited another $100 to win back whatever I’ve lost, but I ended up getting REKT again.

I then logged out of my BYDFI account and never opened it again for a few months. This is where I started learning about trading and crypto.

Looking back, I realise if only I had done my research and read some sensible stuff, things would have been different. Or maybe If I had a beginner’s guide to invest in cryptocurrency, like the one I wrote a few months back (you can find it by clicking here).

My first step to information

After failing, I decided to turn towards information rather than speculation, and I started reading. The first thing I read was bitcoin’s whitepaper, and until then, I didn’t know shit about why it was popular. To be said briefly,

“We proposed a peer-to-peer network using proof-of-work to record a public history of transactions that quickly becomes computationally impractical for an attacker to change.”

Satoshi Nakamoto

I kept reading blogs for a few weeks and kept observing the market from the sidelines. Moreover, now and then, I’d make a trade of a few bucks and take a return. But, gradually, with information and patience, things started changing. Furthermore, I started understanding how technical indicators work, started looking for patterns, and used them to predict market outcomes.

Learning the fundamentals

Before heading back to my trading journey, I decided to learn a bit more about what Crypto is and the fundamentals of a digital asset. So I watched many YouTube videos, staying updated on crypto news through various sources, one of them is the CoinCodeCap YT channel, and started reading blogs; I even started writing them. In between, I started developing an understanding of what project is essential for blockchain and what isn’t.

I read whitepapers of different blockchains or projects such as Ethereum, Matic network or Polygon, The Graph protocol, PancakeSwap, 1inch, etc. The fun part is I even read the white paper, or as they like to call it Woofpaper of Shiba Inu and Dogecoin (and the award for Sh*t coin of the year goes to them).

After learning all of this, I still hadn’t given up on leverage trading and wanted to earn back everything I lost.

Heading back to Margin trading

So this time, I started with depositing funds in my Binance margin trading account. I started with around $50 in USDT at 5x times leverage. I executed a couple of trades, got some returns, and got greedy. Unfortunately, with almost every noob in the market who was trading on leverage and didn’t use stop-loss, I too got REKT on the 19th of May, 2021. After all this time, I learned a lesson, and the lesson was that binance doesn’t provide you with stop loss in margin trading.

What do I trade now?

I don’t, after all of this, I realised I cannot be a person who sticks to the screen the entire day, and all he does is pumping his own blood pressure. Rather, I do the research, buy the coins I believe are good for the crypto economy, and HODL them.

However, finding the right time to sell is the most important part, because if you’re just holding an asset and not trading it once in a while, you’re basically leaving money on the table. I use some technical indicators and chart patterns to determine whether it’s the right time to sell/ buy. I’ve listed some of them below for you!

Technical indicators for a beginner

The first indicator for most traders is RSI; it’s easy to trade using a defined set of numbers, buying when the mark goes below 30 and selling when it goes above 70. However, it only works until you start missing market opportunities.

Moreover, some of the other indicators I learned about are as follows:

- Moving Averages: When an EMA rises, trade the market from the long side, and when it falls, go short.

- MACD Histogram: It is probably the most crucial indicator out there. Moreover, when the histogram peaks, it is time to go short, and when it is at its bottom, it is time to go long.

- RSI: You buy when the indicator goes below 25, and you sell when it goes above 75. However, at times, RSI provides fake signals, and if you only consider it, you’re going to miss opportunities.

- Williams %R: It helps confirm trend reversals, so you buy when it nears 100 and sell when it approaches 0.

Finally, I’d say anything in this article is not financial advice. So, learn the hard way, forget about making easy money.

Trading patterns for a beginner

What I’d say is observing patterns is not difficult; however, you must know where to look for them. After doing my fair share of research, I came across a few patterns, and now I’ll just list them out to you:

- Head and Shoulder pattern: When a bullish or bearish Run is at its end, we sometimes observe the Head and Shoulders pattern. The market moves to a high, does a pullback goes higher, does a pullback, and then goes to a lower high. This will probably indicate that the market is about to reverse.

- The Hound of Baskerville’s signal: It indicates the reversal in the expected market trend. Suppose in the above head and shoulders pattern; if the market moves above the right shoulder, it will undoubtedly hit new highs.

- Rectangles: A rectangle is drawn by joining two or more highs and two or more lows; however, the line must be parallel and horizontal. When the price breaks out of the rectangle, it usually comes back to its outer boundary. This is the time when you trade in the direction of the breakout.

- Flag: A flag is a rectangle whose boundaries are parallel but slant up or down. If the flag is upward or downward, a breakout is more likely and vice versa.

- Triangle: A triangle is a congestion area whose upper and lower boundaries converge on the right. If the upper line is inclined down, a downward breakout is likely. Furthermore, if the downward line is inclined up, an upward breakout is likely.

- Double top or bottom: These patterns can be seen when the prices rally to a previous high or low and are highly likely to reverse.

Brownie points:

- If the market breaks out of a previously tested resistance or support, then a very strong rally is on its way, and you should trade in the direction of the breakout.

- Never let your feelings alter your trading strategy. Crypto trading is a roller coaster ride, you just have to make it till the end without falling out.

Where am I now as a College Investor?

As of September 2021, I am an undergrad and a college investor who is entirely invested in the spot market, and understand the difference between speculator and investor; I try to survive in the long run. However, after learning the hard way, I have realized the very basic thing about investing in any market, and it is not about how much brain you have or how many charts you observe. However, investing is actually about patience, information, and understanding of human nature (because ultimately FUD drives the market).

Until this point, I thought that crypto was, sleep and get rich scheme. As you’d think, I was wrong; crypto is more than just some new technology. Moreover, crypto is here to revolutionize the current financial system,

“Whereas most technologies tend to automate workers on the periphery doing menial tasks, blockchains automate away the centre. Instead of putting the taxi driver out of a job, blockchain puts Uber out of a job and lets the taxi drivers work with the customer directly.”

Vitalik Buterin

I’ll also be leaving few links that can help you get started. I learned things the hard way; however, you don’t need to; we started our CoinCodeCap crypto trading signals telegram channel to help you learn and trade as a beginner.