CoinFLEX extends deliverable swap contracts without any expiration date with up to 100X leverage. For Instance, It provides the first-ever short-term lending Repo market to all its users. Today in this CoinFLEX review, we will look into the features, products, security/ customer support, and pros & cons of the platform.

Table of contents

Summary (TL;DR)

- CoinFLEX is a multifunctional crypto trading platform with various services to offer.

- It offers over six market types, many trading pairs, and selected crypto assets for trading.

- FLEX is a utility token offered by the exchange. Users need to maintain a balance of FLEX for trading and rewards.

- The trading interface might be too intricate to comprehend but has a lot of utilities to provide.

- The exchange is secure and provides active customer support.

- However, The portal is unavailable for US traders and also imposes trading restrictions on some countries.

- With complete security, It is also suitable for anonymous traders as KYC is not essential.

What is CoinFLEX?

CoinFLEX is a crypto exchange platform that extends various financial products for crypto trading and investing. One of the features that make it stand out from other exchanges is delivered perpetual futures. Moreover, It safeguards investors from crypto exposure with low index and price settlement risk.

It is a multifunctional portal with advanced options for passive income. Furthermore, it offers a utility token for a stable trading experience and additional rewards. The trading interface extends diversified market options.

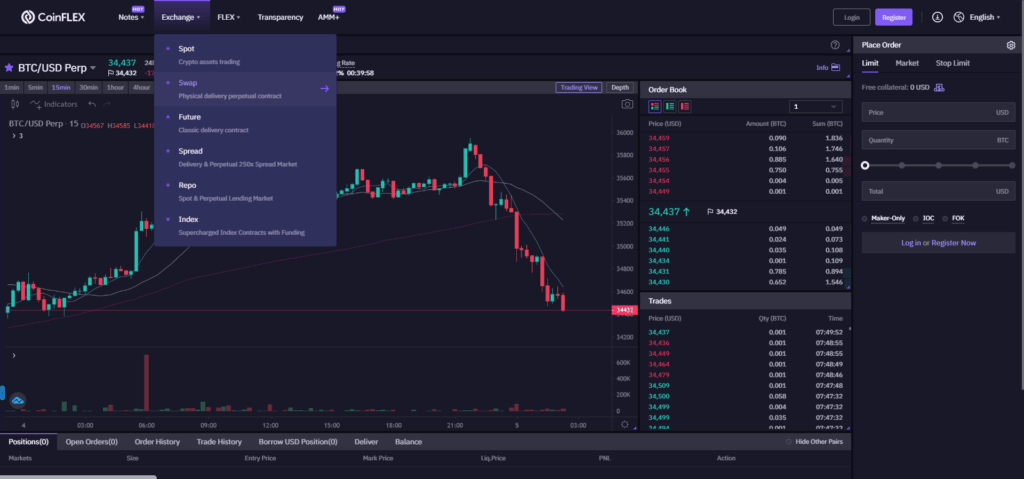

- Spot – Crypto assets trading

- Swap – Physical Delivery

- Futures – Classic Delivery contract

- Spread – Delivery & Perpetual 250X Spread Market

- Repo – Spot & Perpetual Lending Market

- Index – Supercharged Index Contracts with Funding

CoinFLEX Review: Products

The CoinFLEX exchange platform enables massive passive income and trading in varied market types with multiple order types.

Market Selection

CoinFLEX offers various market types – Perpetual, Quarterly, Repo, Spread, and Spot. On selection of the market type simultaneously, a screen displays all the contracts for each market.

Trading Perpetual Swaps

CoinFLEX Perpetual swap is a platform where users trade the price of the underlying asset. In short, It is similar to spot trading with additional 100X leverage. You can check the trading limit at CoinFLEX support.

Quarterly Flex Futures

Quarterly Futures aim at predicting the price of an underlying asset at a given time in the future. The expiration date is noon UTC on the last Friday of the quarter. Eventually, Quarterly contracts turn into perpetual swaps post expiration.

Spread Market

Spread market, aka Basis trading, is a platform for trading the price difference between perpetual contracts and quarterly futures. It has two components/ legs- Perpetual and Quarterly. The former means a price rise {long, buy} and the latter indicates a fall in price {short; sell}. Besides, CoinFLEX offers leverage up to 125 X on each leg of the trade.

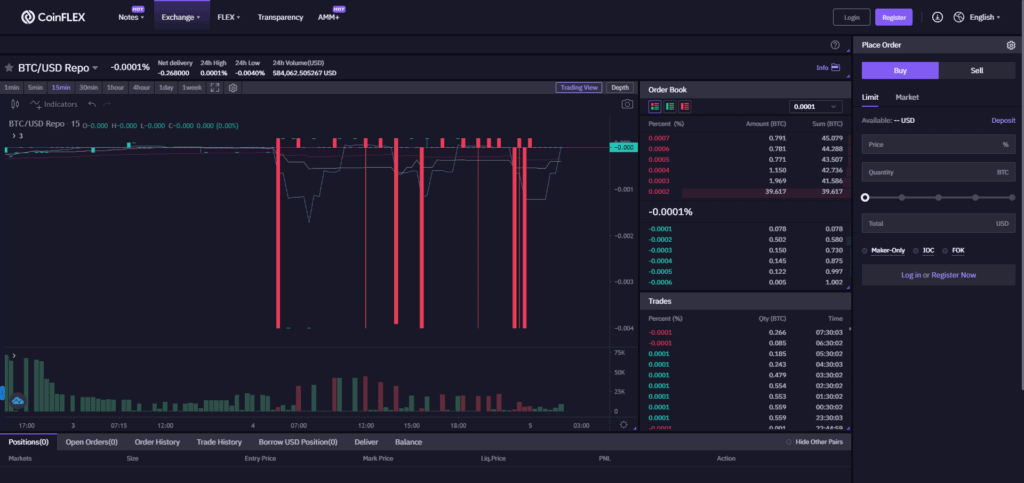

CoinFLEX Review: Repo

The platform offers a crypto Repo market which is 8 hr borrowing/ lending. It facilitates activities between two assets on trade in the repo market. It includes bidding on the repo and the repo price. Repo price at CoinFLEX indicates an interest rate that depends upon demand and supply in the market for borrowing/ lending each asset. Bidding on repo means lending USD in exchange for collateral.

FlexUSD- Yield on Yield

FlexUSD is a stablecoin that pays interest on the base level. Moreover, FlexUSD and all the flexAssets earn interest while sitting in your account, DeFi app, or margin account, in addition to when staked. Thus, it ensures maximum yield on the stablecoin.

CoinFLEX Review: AMM+

Automated Market Making (AMM+) enables traders to earn from the price difference, fees made, and market volatility. CoinFLEX applies this concept specifically to the perpetual futures market, where Users can concentrate their liquidity and deploy capital on AMM strategy. As a result, it results in the better spread and higher liquidity in all trading markets.

AMM+ users can leverage with capital efficiency. Users earn 0.03% FLEX rebates from each transaction.

How to trade on CoinFLEX?

CoinFLEX provides a lot of services and products to traders. Hence, the working of each service varies. However, an in-depth tutorial is available on the website.

Steps to trade Perpetual Swaps

- From the market selector drop-down, select ‘perpetual’ to display the number of contracts.

- Select a trading pair. The first two acronyms in the title represent trading pairs. For instance, BTC-USD-SWAP implies bitcoin to the USD perpetual swap market.

- Enter the quantity and desired price for purchase/ sale. Finally, the order enters into the order book.

- You would receive information on current/ previous trading orders through ‘positions’, ‘active orders’, and ‘filled orders’ tabs.

- Subsequently, You can close the positions by either executing trade in the opposite direction or selecting ‘close’ under the Positions tab. Therefore after successful closure, the position tab should be blank.

- Since CoinFLEX offers deliverable perpetual swap contracts, you can request to deliver an amount based upon collateral/ margin ratio. An estimated amount pops up on the screen of delivery. Alternatively, You can close the position by DELIVER option.

- In the end, after the delivery, the balance appears in the account.

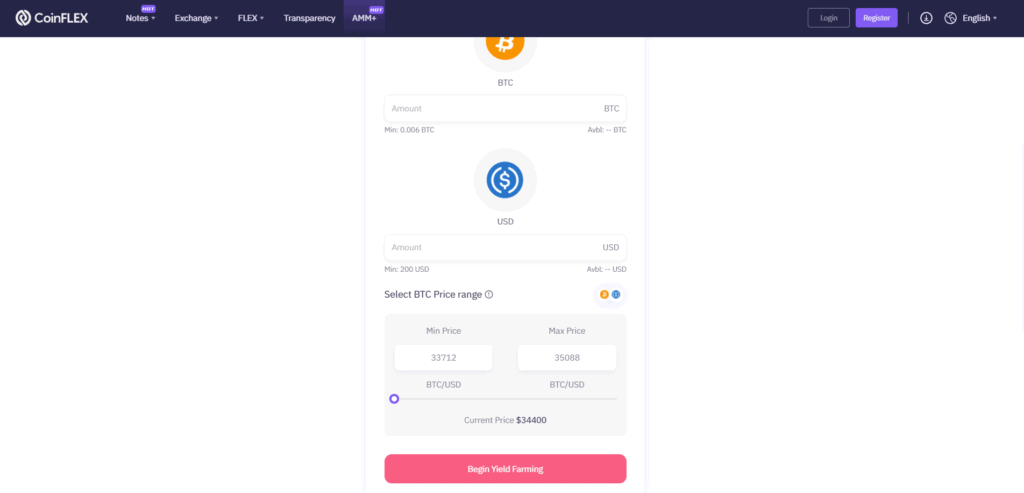

CoinFLEX Review: Steps to trade AMM+

- To begin, choose a leveraged or unleveraged position at CoinFLEX. In the leveraged place, you need to select your assets as collateral at a later stage. Contrarily, an unleveraged position requires choosing trading pairs only.

- Select a direction; go long, medium, or short depending upon market trends.

- Then, choose a liquidity provider trading pair according to the direction strategy. Consequently, at this point, you need to select the amount and collateral in case of leveraged positions.

- Eventually, enter the liquidity amount/ size of the position. Hereafter, select the range where your liquidity concentrates.

- Finally, begin yield farming after confirmation of all details at CoinFLEX.

- You can stop providing liquidity by selecting REDEEM on the respective position.

- Select the desired LP token for withdrawal. Then manually close the position or keep it. Hereafter, the exchange creates a new sub-account automatically. In the case of the long position, redeeming leads to USD delivery of the respective asset of your position.

CoinFLEX Coin

CoinFLEX offers a utility token called FLEX Coin, based on Simple Ledger Protocol (SLP) on the BCH blockchain. Firstly, It is the foundation of the CoinFLEX ecosystem. Secondly, FLEX has unlimited benefits, ranging from transaction fee payment to fee rebates and many more. Lastly, The exchange ensures the demand and regulates the supply of FLEX in the crypto market. Total FLEX supply distribution is as follows:

- Traders (Taker Driven Mining)- 70%

- Lenders (OI Driven Mining, launching soon)- 10%

- Marketing (issues to CoinFlex)- 10%

- Insurance Fund (issued to CoinFLEX)- 10%

Presently, CoinFLEX lending/ borrowing services incorporate FLEX Coin. Also, the amount of FLEX decides the tier level on the platform.

CoinFLEX Review: FLEX coin uses

FLEX coin is beneficial and essential for trading on CoinFLEX. Hence, here are some uses of FLEX on the platform.

- Transaction fee payment on CoinFLEX is only through FLEX coin.

- Traders that hold FLEX have to pay reduced fees. So not only does the fee percentage fall, but traders get rebates with FLEX.

- On purchase or staking of FLEX, traders get rewards in the form of FLEX rebates. For instance, if a trader is staking 1000 FLEX, s/he might receive 40 additional FLEX coin as a reward.

- Traders can stake FLEX in either insurance funds or bankroller funds for potential returns.

A trader can purchase FLEX on the FLEX/USD spot market and few other exchanges. Furthermore, CoinFLEX aims to increase the utility of FLEX with time.

Where to Trade FLEX Coins?

Several exchanges support FLEX as a crypto asset on their platform for trading. Moreover, traders can withdraw FLEX on SLP/ERC20 compatible wallets like badger.bitcoin.com.

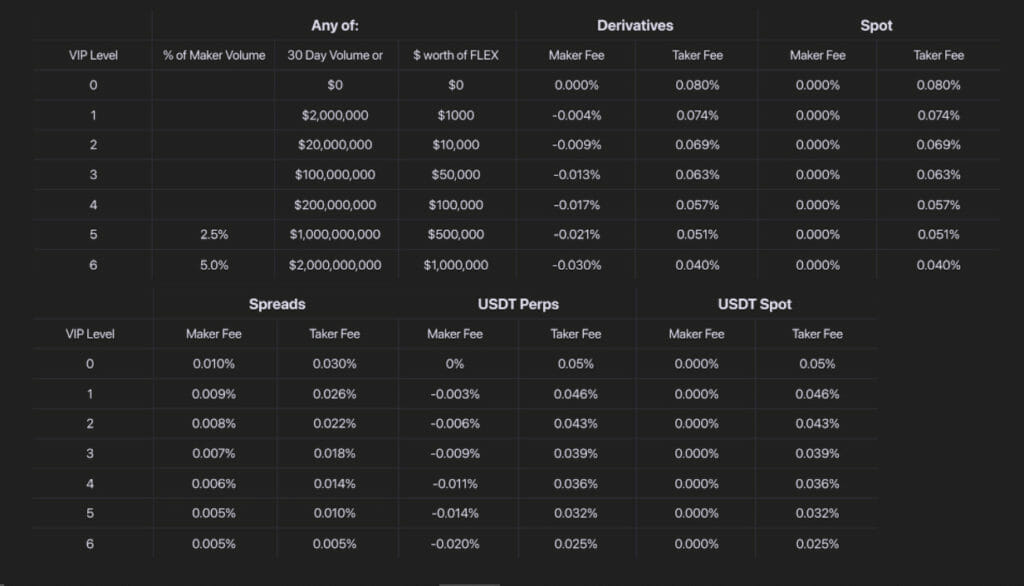

CoinFLEX Fees

CoinFLEX offers the lowest fees in the market on derivatives and spot trading. However, Prices fluctuate by the amount of FLEX a user holds.

- IOC and FOK orders are takers and pay a taker fee.

- An order that enters in the book before execution and another user fills as taking is a maker order.

- Spread orders attract spread fees.

Furthermore, you can avail yourself discounts on fees by using FLEX coin to pay the fees; rebates transact in FLEX.

Moreover, CoinFLEX does not charge a deposit fee. Furthermore, withdrawals for BCH, FLEX coin, and DOT are free for all users.

Also, there is no service fee.

CoinFLEX Review: Security

CoinFLEX extends a robust and strategic exchange to traders. It has a three-fold security approach for the platform.

First, it stores 99% of the customers’ funds in cold storage. It keeps the remaining 1% in a secured hot wallet for day-to-day transactions. Second, it uses Transport Layer Security (TLS) to protect customer data. TLS sticks to strict procedures to avoid unauthorized access.

Moreover, It ensures the safety of a confidential customer database. Third and Last, the exchange has a compulsory two-factor authentication. However, SMS authentication is not a safe option, as per CoinFLEX. So, users need YubiKey (a USD stick OTP generator) or Authy (Google Authenticator) to access their accounts.

Customer Support at CoinFLEX

Firstly, the platform provides an extensive FAQ section. It has all the questions and details regarding trading, products, user Interface, technicalities, and many more. Secondly, It has an internal ticket system along with email support. Lastly, it has an immediate customer support solution. The team is accessible on Twitter, Telegram, and LinkedIn.

CoinFLEX Review: Pros and Cons

Like any other exchange, CoinFLEX has its advantages and disadvantages.

Pros

- 250X Leverage

- Multiple Accounts Division

- Low Fees

- No KYC

- Physically Delivered Perpetual Swaps

- A Wide Variety of Trading Pairs

- Transparent Fee Structure

- Prompt, Responsive Customer Support

Cons

- Low Liquidity

- does not support US Citizen

- Complicated Trading Interface

- Trading Restrictions for some Countries

- Limited Crypto Assets Supported

CoinFLEX Review: Conclusion

CoinFLEX is trying to break the monotony with diverse passive income options, crypto trading, and multiple market types and trading pairs in one place. Apart from this, It is the first-ever platform to offer deliverable perpetual swaps contracts. Although it might be complex for beginners, it is a suitable choice for traders who want several trading options and transparent fees with primary crypto assets at their disposal.

Frequently Asked Questions

CoinFLEX supports which crypto assets?

CoinFLEX supports BTC, ETH, USDT, FLEX, BNB, REVV, XRP, GOC, Aave, Reserve Rights Token, OMG, DASH, LTC, DOT, and a few others.

Is CoinFLEX safe?

Security at CoinFLEX is a serious matter. Therefore, it has multiple setups to ensure the safety of users’ funds and data.

What makes CoinFLEX different?

CoinFLEX is different from other cryptocurrency exchanges in multiple ways.

– First, It offers deliverable perpetual swaps contracts.

– Second, it extends various market types and trading pairs.

– Lastly, Fees are competitive from any other exchange.