With changing times, traders don’t are turning away from centralised exchanges and platforms and adapting to decentralised exchanges. Hence, in this article, let us dwell a little deeper with a simple understanding of DEXes and decide which is the best decentralized exchange.

| Exchange | Supported Crypto Assets | Fees |

|---|---|---|

| Uniswap | ERC-20 Tokens | 0.3% fee for swapping tokens |

| SushiSwap | 100+ tokens | 0.3% of the total value of the transaction |

| 1inch | 400+ ERC-20 tokens | exchange fees and gas fees for the transactions |

| Bisq | 11 Coins | Deposit fees vary |

| PancakeSwap | BEP-20 tokens | 0.2% of transaction value |

| Balancer | ERC-20 tokens | Fees is Variable |

| Bancor | BNT and ETHBNT | Fees is Variable |

| Mandala Exchange | __ | 0.30% per transaction |

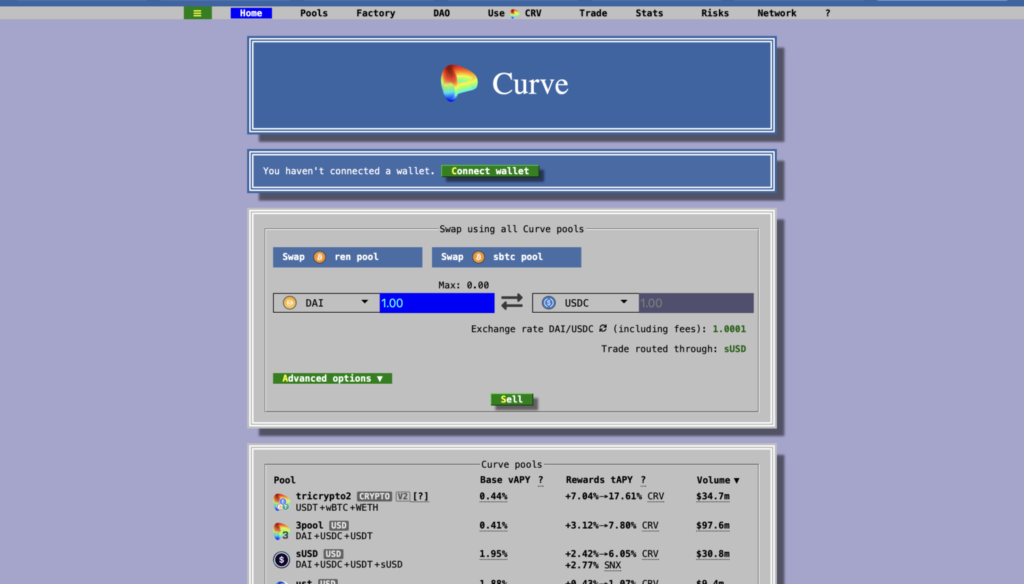

| Curve Finance | ERC-20 tokens | 0.04% of transaction value |

| Raydium | __ | 0.25% of transaction value |

Table of Contents

Summary (TL;DR)

- With each exchange getting better than the other, there are always difficulties in choosing the more reliable decentralized exchange.

- Here are the best ten picks of DEX to begin your trading: Uniswap, Sushiswap, 1inch Exchange, Bisq, PancakeSwap, Balancer, Bancor, MDEX, Curve Finance and Raydium.

- Uniswap is a popular DEX which uses a relatively new trading model called an automated liquidity protocol, but it is the hardest to understand.

- SushiSwap has an easy to use interface with yield farming. However, it is not highly secure.

- 1inch is a popular DEX aggregator, but it is not available in the U.S.

- Bisq is the most dedicated decentralized exchange platform, but then the interface is hard to use.

- PancakeSwap runs on Binance Smart Chain, but it doesn’t have margin trade.

- The Balancer is one of the top 10 largest DeFi platforms on Ethereum, with no verification required.

- Bancor offers incentives to users to lock their crypto assets in pools in exchange for rewards once they are bought and sold by traders.

- MDEX is an acronym for Mandala exchange which is built on the Heco chain. It uses transaction and liquidity mechanisms in its mining operations.

- Curve finance is a decentralized exchange that focuses on the trade of stablecoins.

- Raydium is built on the Solana blockchain, but it is only unified with one DEX.

At a Glance

What is Decentralised Exchange?

A decentralized exchange or DEX is the essence of a crypto exchange and one of the main components of decentralized finance (DeFi). In DEX, you never lose control of your assets and all the transactions take place directly through your wallet. Further, the decentralized exchanges eliminated the need for middlemen in a transaction

1st Best Decentralized Exchange: Uniswap

What is Uniswap?

Uniswap is one of the best DeX platforms that was built in 2018 using Ethereum Blockchain, a database of information intended to be unhackable. Thus, it is used for swapping ERC20 tokens. Furthermore, it uses a relatively new trading model called an automated liquidity protocol where traders become liquidity providers.

What makes Uniswap stand out is its pricing mechanism called Constant Product Market Maker Model. In this mechanism, you can add any token to the decentralized exchange by endowing it with an equivalent value of the ETH and ERC20 tokens. Read our Guide to Uniswap to know more.

Uniswap Feature

- A popular decentralized exchange.

- Runs on Ethereum Blockchain.

- You can exchange all the ERC20 tokens.

- Use of a new trading model called automated liquidity protocol.

- Each token has its smart contract and liquidity pool.

- For new tokens, you can create a liquidity pool.

Pros and Cons

| Pros | Cons |

|---|---|

| No KYC process | Hardest DEX solutions to understand. |

| Full custody of the invested capital is given | Fake coins might also be listed |

| Low Fees | |

| Uniswap’s liquidity pools can be utilized to earn. |

2nd Best Decentralized Exchange: SushiSwap

What is SushiSwap?

SushiSwap, based on Uniswap’s code, is a famous rival to its original counterpart. Thus, it is also an Ethereum-based decentralized exchange. It allows traders to swap a vast collection of tokens as well as engage in other financial services. Furthermore, it also relies on smart contracts and liquidity provided by users.

SushiSwap’s history may be controversial and dramatic, but it has established itself more appropriately with a better design and interface in the present. It has copied many things from Uniswap but with a critical addition of a governance token called SUSHI.

SushiSwap Features

- Built on an Automated Market Maker (AMM) system.

- Use of smart contracts to complete various transactions.

- Allows the SushiSwap users to lock up their funds.

- Yield Farming: Users get rewarded with a small percentage of fees generated by traders.

- Provide other DeFi features.

- The SUSHI token provides users with an additional means of generating rewards and grants a say in the future of the DEX.

Pros and Cons

| Pros | Cons |

|---|---|

| Yield Farming | Availability of other DeFi services |

| Easy to use platform | Controversial and drama behind the scene entry |

| Controversial and drama behind the scene entry | Not highly secure |

3rd Best Decentralized Exchange: 1inch

What is 1inch Exchange?

The most notable feature of 1inch is that it is a DEX aggregator. A DEX aggregator chooses the best and the cheapest prices among decentralized exchanges to help its customers to proceed with the best-prized trading.

1inch is a non-custodial exchange which means you must employ a third-party wallet such as Metamask, to use its services. Read our complete Guide to 1inch to know more.

Features

- It is a DEX aggregator.

- Multiple wallets can be used by the traders.

- Users can earn money by placing the coins in the liquidity pool.

- It offers a good collection of cryptocurrencies.

- If a token the user wants to trade with is not available, you can add it.

Pros and cons

| Pros | Cons |

|---|---|

| Finds the best prices to trade with | Gas Fees |

| No fees | Not licensed in the US (About to Launch a dedicated US platform) |

| Works with various wallet | Complicated for new investors |

| Huge range of cryptocurrencies |

4th Best DeX Platforms: Bisq

What is Bisq?

The traders who are critical in their ideologies towards the essence of cryptocurrency use Bisq. It includes the core ideas of decentralization such as censorship resistance, user security, transparency, safety, and additional privacy. In addition to this, Bisq’s server is scattered around the globe, making it hard for hackers to hack all the servers and gain important information. All of this makes this decentralized exchange very secure for traders. To learn more, read Bisq — A Peer to Peer Bitcoin Decentralized Exchange.

Bisq Features

- Based on the core values of decentralization.

- Highly secure due to scattered servers.

- Transparent conduct and additional privacy.

- Various payment options are available for buying crypto.

Pros and cons

| Pros | Cons |

|---|---|

| Highly secure | Decentralization is not for every trader |

| Traders control their funds and wallet keys | Less efficient interface design |

| Anyone can trade and invest from anywhere; therefore, no global restriction. | |

| It is dedicated to decentralization. |

5th Best Decentralized Exchange: PancakeSwap

What is PancakeSwap?

PancakeSwap is a decentralized exchange similar to Uniswap, but instead of running on Ethereum blockchain, PancakeSwap runs on Binance Smart Chain. In addition, it also helps in keeping close supervision on the tokens.

The interference feels very similar to Uniswap. However, it also allows the users to get rewards by excluding the middle-man if they are willing to lock their tokens for some time.

Also, read Where and How to Buy PancakeSwap (CAKE) Token in 2021?

Features

- It is based on the Binance Smart chain blockchain, which offers fast and cheap transactions.

- Most of the popular coins are available to trade.

- A Lottery is available through which traders can win a lot of money.

Pros and cons

| Pros | Cons |

|---|---|

| Transaction costs are cheaper. | No margin trading. |

| It is fast and easy to use. | |

| Users gain more profit. |

6th Best Decentralized Exchange: Balancer

What is Balancer?

It is a decentralized exchange running on the Ethereum blockchain. It utilizes liquidity pool protocol for swapping ERC-20 assets with no intermediary. Balance is accessible to all as long as they have a supported wallet installed. It is one of the top 10 largest DeFi platforms on Ethereum.

Features

- Users do not need to create an account.

- No verification is required.

- Pool operators have the liberty to set their swap fees.

- One of the cheapest places for trading stablecoins.

- The creation of various types of liquidity pools is available.

Pros and cons

| Pros | Cons |

|---|---|

| Pools can be created with several tokens. | Balancer aggregates only the in-house liquidity pools. |

| Pools can be made with different proportions. | |

| Users can provide liquidity to the pools without having many resources. |

7th Best Decentralized Exchange: Bancor

What is Bancor?

It facilitates the operation of Automated Market Maker (AMM). In addition, it offers incentives to users to lock their crypto assets in pools in exchange for rewards once they are bought and sold by traders.

Bancor allows seamless conversions of Crypto tokens. In addition, it also maintains several self-governing tokens.

Features

- Bancor provides liquidity to small and micro-cap coins.

- It utilizes two token layers.

- Use of Smart contracts.

- Recalculation of prices using the Bancor formula.

Pros and cons

| Pros | Cons |

|---|---|

| Transparent pricing secured through Bancor formula. | Fiat currency is not supported. |

| Due to the unique business model, there is low risk. | Margin trading is not supported. |

| A good number of ERC-20 tokens are supported. |

8th Best Decentralized Exchange: Mandala Exchange

What is Mandala Exchange?

MDEX is an acronym for Mandala exchange which is built on the Heco chain. It uses transaction and liquidity mechanisms in its mining operations. Further, the Mandala exchange is powered by Binance Cloud and charges a fee as low as o.05%.

Features

- Operates on dual mining that provides a secure transaction experience.

- In addition, it introduces its users to innovative zones where traders can trade with more volatile tokens.

- Transparent rules.

- The process is faster and cheaper in comparison to Ethereum

- Mining and liquidity methods are easy and reliable.

Pros and cons

| Pros | Cons |

|---|---|

| Additional zones. | MDEX has a good number of Asian users due to which market conditions get affected. |

| Cheap transaction fees. | Complicated to beginners. |

| High transaction speed. | The platform is not available in many regions around the world. |

| Users can switch poles. |

9th Best Decentralized Exchange: Curve Finance

What is Curve Finance?

Curve finance is a decentralized exchange that focuses on the trade of stablecoins. In addition, it offers a lower fee and minor slippage. It also grants users rewards that give liquidity to the exchange.

Features

- It is focused on Stablecoin Exchange.

- It supports the following stablecoins: GUSD, TUSD, BUSD, DAI, USDT, etc.

- Curve finance is an AMM protocol.

- Liquidity to the pool is created by users who deposit stablecoins in the liquidity pools to become liquidity providers.

- Smart contracts are used to enable traders to trade with the pool.

- Algorithms determine the price of liquidity pool assets.

Pros and cons

| Pros | Cons |

|---|---|

| Stablecoin Exchange is available. | Complex interface for beginners. |

| It provides other services. | High fees. |

| Cheap and low slippage. | Limited amount of trading pairs. |

| A good number of liquidity pools to choose from. | |

| Yield farming is available. |

10th Best Decentralized Exchange: Raydium

What is Raydium?

It is an AMM and liquidity provider which is built on the Solana blockchain. It provides fast transactions with low fees. Further, Raydium allows you to swap, provide liquidity for any SPL token, a launchpad for Solana Projects, and earn Yield on your crypto through yield farming.

Features

- Raydium offers on-chain liquidity.

- Users can become liquidity providers and earn rewards with each swap.

- There are many wallets available to choose from.

Pros and Cons

| Pros | Cons |

|---|---|

| Fast transactions. | Its union is with only one DEX that is the serum. |

| Shared liquidity. | |

| Low fees. | |

| It provides access to serum’s DEX order book. | |

| Easy to use interface. |

Best Decentralized Exchange: Conclusion

The crypto market is enormous, and there are many decentralized exchange platforms to choose from. It is obvious Centralised exchanges can be pretty easy to use for beginners as they are simple to use and learn. However, only until you have a very insignificant trading volume. If you’re trading more than a 4 digit number it is evident that you’d want to have complete control over your funds. Hence, DEXes help you achieve that. One of the best decentralized exchanges 1inch provides the lowest exchange rates in the market. Hence, according to us, it would be the best option to trade on a Dex.

Frequently Asked Questions

What is the most popular DEX?

Uniswap is the most popular DEX and, thus, is widely used by users.

What is the largest DEX?

The largest and the best decentralized exchange is Uniswap.

What is the most decentralized cryptocurrency?

Ethereum, with its decentralized platform, allows different decentralized applications and smart contracts to be built and run on the decentralized software platform. So, it is no surprise that Ethereum (ETH) is the most decentralized cryptocurrency.

Which crypto wallet is best?

Several crypto wallets are: –

• Wasabi Wallet

• Exodus Bitcoin & crypto wallet

• Edge

• Trezor T

Can a decentralized exchange be hacked?

A decentralized exchange is safe from DEX’s large-scale hackers because they cannot access a single decentralized wallet or server. After all, the server does not ask for personal details and access to user funds.

Also, read