In this article, we will review the DeFi Money Market project(DMM). According to the white paper, the team aims to build

“a permissionless and fully decentralized protocol to earn interest on any Ethereum digital asset backed by real-world assets represented on-chain.”

We will first explain the DMM project, then highlight some of the caveats and challenges around it. In the end, we will share what we think about the project. But first, let’s dive into the problem which DMM trying to address.

The Problem

The combined market cap digital assets is more than $200 billion today. There are two leading cryptocurrencies Bitcoin and Ethereum, with more than $120 billion and $18 billion in market cap, respectively.

However, most of the digital assets are sitting idle, not producing any yield. So think of $200bn worth of assets with no returns and can’t be diversified out of the digital ecosystem without selling them.

In the last few years, the DeFi ecosystem grew rapidly on Ethereum, and we saw money market protocols producing yield for Ethereum and other tokens, such as Aave, compound, etc.

All these money market protocols use Eth and other Ethereum tokens as collateral to produce yield. Though fluctuation in the value of digital assets creates two main problems for an ordinary investor.

- Fluctuating interest rates — Protocol adjusting interest rates frequently to maintain the collateral ratio.

- High risk of asset liquidation — High price volatility creates a risk of asset liquidation.

We need more robust ways to produce yield for digital assets such as Ethereum or Bitcoin.

Consistent Yield and Growth of Crypto

Negative interest rates inverted the time value of money. Banks started charging people to put their money in banks, and you will get paid interest if you borrow the money.

As fiat currency is moving towards negative yield, investors around the world are looking for new asset classes to get a consistent positive return on their money.

A digital asset with consistent yield and positive time value will attract new investors into the crypto ecosystem who are looking to safeguard their money.

“Consistent interest rates with positive time value of the asset will stampede the crypto ecosystem with new investors who came to safeguard their money, not to invest in a get rich quick scheme. It will be a fundamental shift in the preception of digital assets in an investor’s mind”.

DeFi Money Market (DMM)

So how DeFi Money Market comes into the picture? DMM aims to build a decentralized protocol to earn interest(yield) on any Ethereum digital asset by lending them for the real-world assets(Vehicles, real-estate, etc..) as collateral.

So investors can lock their fund (ETH, DAI, USDC) in DMM protocol, DMM will lend them to borrowers for real-world assets as collateral and profit generated will get distributed to investors.

I know you have a lot of questions now, but let’s dig into DMM protocol first and understand how it works.

Components of DMM

So DMM introduces a few new things, DMME, DMMA, DMMW, mAssets, etc. Let’s dig them one by one.

DMME (DeFi Money Market Ecosystem) — In simple words, DMME is the DMM procotol. As white paper explains,

“The DMME is an Ethereum-based and decentralized protocol that allows the creation of DeFi Money Market Account’s (DMMA).”

DMMA (DeFi Money Market Account) — DMMAs are ERC20 tokens, which get created when we swap DAI (or any other supported Ethereum token) into corresponding DMM tokens DMM: DAI using a smart contract.

DMM: DAI will be represented by the mDAI symbol (small m letter as the prefix of the underlying asset).

This is true for every Ethereum token supported by DMME, such as mUSDC, mETH, and so on. We will call these assets as mAssets.

According to the white paper, DMMA is

“A new DeFi native asset class that allows any holder of an Ethereum-based digital asset to earn interest and is backed by real-world assets represented on-chain.”

So basically, DMMA = mAssets = DMM tokens.

DeFi Money Market Wrapper (DMMW) — DMMW is an ERC20 smart contract wrapper that can be placed on any Ethereum token to generate income and provide additional diversification and security through backing by real-world assets represented on-chain.

Oracle — Blockchains do not have access to the outside world. Therefore, Oracles provide external data to blockchains in a secure way. These oracles are decentralized networks which use multiple data source for the same type of data. DMM utilizes the Chainlink oracle network to pull real-world information into the blockchain.

There more things involved, but let’s stop here before you sleep and understand how DMM protocol works in general.

How does DMM Protocol work?

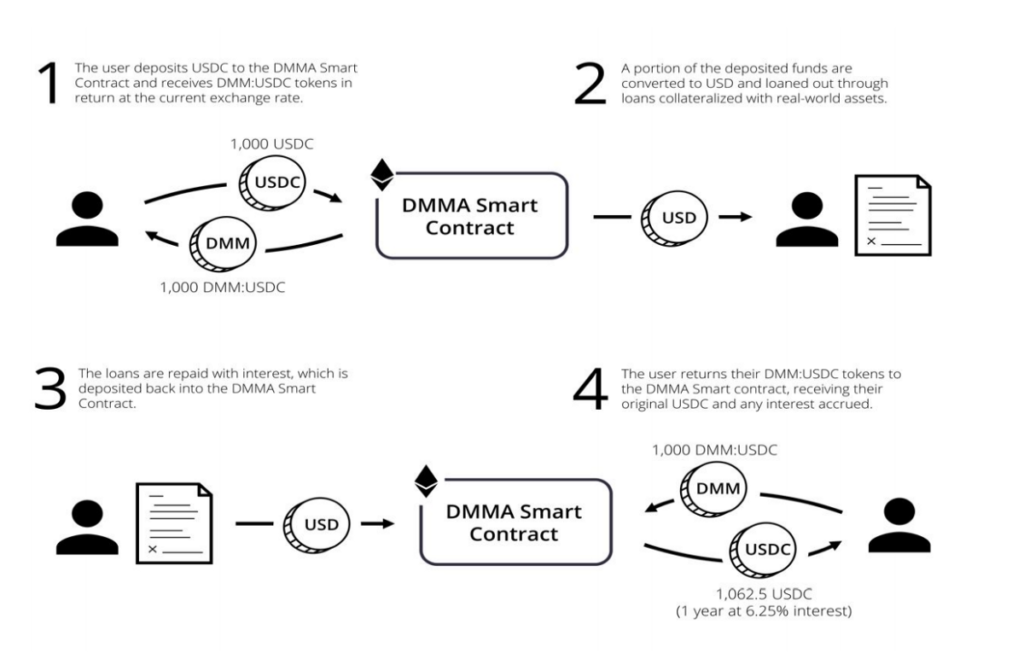

Let’s get an overview of DMM protocol. For brevity, we are taking USDC as an example.

- A user will deposit USDC and mint mUSDC

- Deposited funds will be converted into fiat (USD)

- USD will be used to provide loans collateralized with real-world assets

- As loan gets repaid, interest will be deposited back to the protocol

- Users can convert mUSDC to USDC with interest

Now let’s dig deeper using USDC as an example.

- Initially a user need mint mUSDC

- Once minted you will get mUSDC depending on the current exchange rate

- As whitepaper suggests you can convert this mUSDC to USDC any time, there is no locking period

- So now DMM foundation will withdraw deposited USDC partially in convert it into fiat

- Using this fiat, DMM Foundation provides loans to borrowers at a particular interest rate. For now, it will offer loans in the Auto sector as the team behind it has to experience in that market.

- Whenever the DMM foundation provides any loan, it will push the legal contract and other data points to DMM protocol using Chainlink oracle.

- On the other hand, the vehicle valuation will continuously be fed to DMM procotol through chainlink using blackbook.

- This way, the protocol (DMM foundation) can auction these vehicles in case of non-payment or collateral coverage ratio drops below a certain point.

- Interest and payment collected in fiat will be converted into digital assets and deposited back to the smart contract.

To understand the protocol in more detail, read the whitepaper.

But there are a lot of moving parts and caveats here. Bringing real-world assets into blockchain creates several challenges.

Challenges, Risks, and Mitigations

DMM is the first project trying to bridge the real-world and blockchain seriously. When I say seriously, it means “$10 million seriously”. DMM foundation bootstrapped the protocol by locking $10 million in it.

Tracking Fiat operations — Once crypto is converted into fiat for lending, tracking it will be the most challenging part. In this case, we need to trust the DMM foundation.

Centralization — Initially DMM foundation takes the front seat and will be in charge of the lending operations and other fiat and crypto funds. So investors have to trust the foundation. Though to solve this problem, the DMM foundation is creating a DMM Dao which will vote on the crucial decision related to protocol and the foundation. For this DMM foundation creating a DMM Governance Token DMG, which is getting distributed though dutch auction.

Collateral Valuation — There is always a risk of real-world assets gone corrupt or unrecoverable. To solve this protocol will be over collateralized by maintaining Low LTV (Loan to Value ratio) and diversify lending in different liquid markets all over the united states.

Data corruption and availability — The team will use Blackbook for valuation, which is a reputed source, but more valuation sources will be needed to remove the risk of collusion. Besides, fiat data and other DMM foundation operation data will be provided by the foundation. Therefore, so in this case, we need to trust the foundation.

Asset Confiscation or Legal problems — Unlike digital assets, real-world assets can be confiscated; in this case, there is always a risk of asset confiscation by the state for XYZ reasons. Besides, there are still legal problems that can be arises with these assets.

ETH Volatility model — DMM’s main value proposition is to provide consistent yield for ETH. But Eth is a volatile asset, and DMM wants to hedge ETH’s volatility using Options trading. We think the foundation needs to scale the protocol and build other necessary tooling using USDC and DAI stablecoins before moving into a highly volatile asset like ETH. We think its too early to increase the complexity before solving existing problems.

Other software and smart contract vulnerabilities can also jeopardize the procotol, but it can be avoided by following the best engineering practices. In the case of DMM, the attack surface is huge, as it involves real-world assets.

Conclusion

Bringing real-world assets into blockchain is a big challenge, and DMM is trying to solve it by choosing the right tools and market.

It will take a humongous effort to mitigate the risks mentioned above, but the team is competent, experienced, and dedicated to solving these problems.

We also think there is a massive opportunity if crypto enables consistent interest in a more transparent way using hard real-world assets. However, the biggest problem for the project is to decentralize all the aspects of the protocol in the future.